While ServiceNow, Inc. (NYSE: NOW) Shareholders are likely to be generally happy, the stock hasn’t had a particularly good run recently, with the share price dropping 26% in the last quarter. But over five years the returns have been very good. To be precise, the stock price is 464% higher than five years ago, an impressive performance on any scale. So we don’t think the recent drop in share price means its story is a sad one. Of course, the most important is whether the business can improve itself continuously, thus justifying a higher price.

Since long-term performance is good but there has been a recent pullback of 4.4%, let’s see if the share price fundamentals match.

Check out our latest review for ServiceNow

Since ServiceNow has earned little in the past twelve months, we will focus on revenue to measure its business growth. As a general rule, we think this type of company is more comparable to losing stocks, because the actual profits are very low. In order for shareholders to have confidence that the company will grow significantly in revenue, it must grow in revenue.

Over the past 5 years, ServiceNow has seen its revenue grow by 28% per year. That’s higher than most pre-profit companies. Fortunately, it didn’t miss the market, and pushed the share price by 41% per year at the time. Despite the strong run, top performers like ServiceNow are known to have consistently won over the decades. So we recommend that you take a good look at this one, but keep in mind that the market seems optimistic.

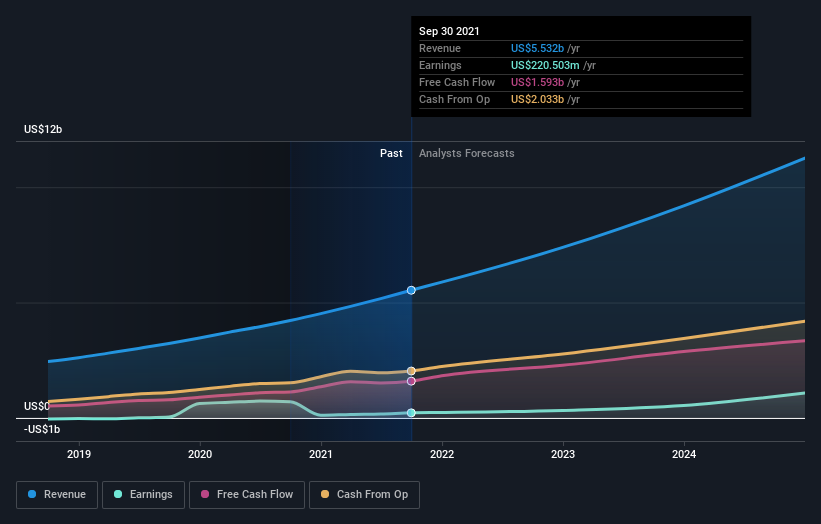

The company’s revenue and earnings (over time) are illustrated in the image below (click to see the exact numbers).

It’s probably noteworthy that we saw significant insider buying in the last quarter, which we consider positive. On the other hand, we think revenue and profit trends are more significant business dimensions. If you are thinking of buying or selling ServiceNow stock, you should take a look at this Free report showing analyst earnings forecasts.

A Different Perspective

ServiceNow shareholders were down 6.2% for the year, but the market itself was up 5.6%. Although the share prices of good stocks go down sometimes, but we want to see improvements in the key metrics of a business, before becoming too interested. Long -term investors won’t be too upset, as they will get 41%, per year, over five years. If key data continues to indicate long-term sustainable growth, the current sell-off may be an opportunity to consider. While it is worth considering the various effects of market conditions on the share price, there are other factors that are more important. To that end, you should know 3 warnings we found in ServiceNow.

ServiceNow is not the only stock that insiders buy. For those who love to search winning investment ito Free list of growing companies with recent insider purchases, may be the only ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks currently trading on U.S. exchanges.

Do you have feedback on this article? Worried about content? Please contact directly to us. Alternatively, email editorial-team (at) simplywallst.com.

This Simply Wall St article is general. We provide commentary based on historical data and analyst predictions using only an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take into account your goals, or your financial situation. We aim to bring you long -term focused analysis driven by core data. Note that our review may not be a factor in the latest company announcements that are sensitive to price or material quality. Simply Wall St does not have a position on any of the stocks mentioned.