nimuratdeniz/iStock by Getty Images

Fresh works’ (NASDAQ: FRSH) The IPO entered in at over 40x profits. However, the stock saw a significant correction despite strong earnings growth.

One about the aspect is the lack of free cash flow force. Per management’s commentary in 1Q 2022, from Q4 onwards, free cash flow should be positive. We think operating leverage kicking in could spin the stock’s fortunes, and a 35%+ return from the stock can’t be eliminated.

What does Freshworks do?

Freshworks provides SaaS products for customer experience and IT service management, launching new products in salesforce and marketing automation.

Company filing

As part of the company’s product evolution, Freshworks is now focused on building a unified customer record, which will aggregate data across marketing, communication support, self-service bots, and sales to a unified customer record. The first industry Freshworks targeted was the e-commerce market with a partnership with Shopify (SHOP), with plans to expand to the likes of WooCommerce and Magento (ADBE).

Company filing

The company focuses on SMBs, and a USP of Freshworks products has been the speed at which these products can be launched – 8 to 10 weeks compared to 12 to 18 months in the case of traditional players.

Company filing

Notably, most of the management team worked with competitors and thus knew the market well.

Company filing

Business performance

As a subscription software or SaaS company, one of the key metrics is the ARR or the annual recurring revenue, which is defined by the company as follows:

For monthly subscriptions, we take the recurring run-rate of revenue of such subscriptions for the last month of the period and multiply it by 12 to arrive at ARR.

Source: 10 -K – 2022

Company filing, author review

Freshworks customers with ARRs in excess of $ 5K and $ 50K have seen steady growth, with management remaining positive about momentum and visibility, especially from newer launches and partnerships.

While revenue in 1Q 2022 grew 42% y/y to $ 114.6 million, more than estimates, the stock fell on concerns about demand, as evidenced by commentary around the charges.

From a new business perspective, the growth of charges was impacted by the lower number of large deals closed in the quarter. Although we added a steady number of new customers in Q1, the average customer size was smaller compared to the previous quarter as our field operations continued to develop and increase productivity for the mid-market and more. large customers. We also see a very competitive hiring environment on the go-to-market side, especially in Europe. Thus, it affected our realization of sales in that region.

Although we do not manage the business on a calculated scale of charges due to the general uncertainty in the European market and the time required to form go-to-market operations, we expect the calculated growth of charges will be modest in Q2.

Source: 1Q 2022 Freshworks’ earnings Call

Company filing

The main issue seems to be insufficient GTMs in the field, leading to insufficient growth. One of the reasons management featured was the procurement challenges, which have changed significantly over the past 45 days. While uncertainty remains from Europe and FX, we think Q2 charges may come as a surprise.

Finance

The main concerns in the slowdown in demand can be summarized in the following graph.

Company filing

We have noticed that the decline in growth charges in relation to revenue growth has led to speculation around whether demand for Freshworks products is strong enough. In addition, management’s comment on inadequate procurement can be seen from SG&A’s cost as a percentage of revenue.

Company filing

We think management will benefit from the recent successive layoffs at startups and the consequence of the delay in the job market. A less challenging environment can also allow for lower money burn.

Additionally, management’s guidance on 35% growth in F2022 looks conservative due to momentum in customer addition metrics. While it makes sense to cook up the challenges at GTM, after adding 2,100 customers in 1Q 2022, unless something drastic happens, we think the company could clock revenue growth of more than 40% .

Looking for Alpha, Author review

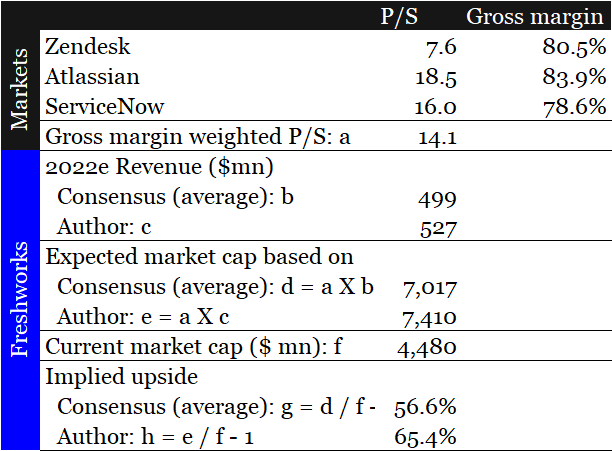

Given the size, growth and total margin of Freshworks, we found the company’s properties closest to Zendesk (ZEN), Atlassian (TEAM) and ServiceNow (NOW).

We noticed that Freshworks ’gross margins were north of 80%, and so we applied a gross margin weighted P/S multiple to express the potential increase in the company’s stock price.

Company filing, Alpha Search, Author Review

Our analysis yields an increase of 55-65% from current levels, where a conservative investor could apply a 20% reduction to get 35-45% coverage. The 20% reduction is for a deteriorating macro environment.

Risks in our thesis

We think the main risk in our thesis is how Freshworks is addressing issues with the company’s GTM implementation.

I think it’s an internal implementation on the GTM side that we’re still dealing with ramping reps who need to close more deals. And we will – we have already made the investments, and we are confident that it will pay off in the coming months and quarters.

Source: 1Q 2022 Freshworks’ earnings Call

Freshworks is a relatively young participant in customer service and IT service management, where competition for talent is overwhelming. Its marketing strategy management strategy will significantly affect money burning, profitability, and affiliate talent attraction. Thus, next quarter’s results will be critical for Freshworks to establish itself as a serious player in the service management market.

Another danger is around macros and the spillover effect that Russia-Ukraine geopolitics could have in Europe and in forex.

Conclusion

Freshworks has lost more than 2/3 of its value since the time the company listed, as the stock continues to decline. We think the management’s comment of another $ 20 million to FCF did not inspire much confidence in the stock. However, as we look to the future, business traction may be positively surprised, leading to a 40-60% return.