In the past three months, ServiceNow (NYSE:NOW) stock has risen 14%. Given that the market will reward strong financials in the long run, we want to know if this is the case in this case. In this article, we decided to focus on ServiceNow’s ROE.

Return on equity or return on equity is a test of the company’s appreciation of value and the effectiveness of managing investor funds. In other words, it is a profit rate that measures the return on capital provided by the company’s shareholders.

Check out our latest analysis of ServiceNow

How is ROE calculated?

ROE can be calculated using the following formula:

Return on equity = net profit (from continuing operations) ÷ shareholders’ equity

Therefore, according to the above formula, the ROE of ServiceNow is:

26% = US$701 million ÷ US$2.7 billion (based on the past twelve months to September 2020).

“Return” is the income that the company earned last year. Therefore, this means that for every dollar invested by shareholders, the company will get a profit of $0.26.

What is the relationship between return on equity and income growth?

So far, we have learned that ROE can measure the efficiency of a company’s profit generation. Based on how much of the company’s profits are reinvested or “retained”, and how effective this is, we can assess the company’s profitability growth potential. Assuming all other conditions remain the same, the higher the ROE and profit retention rate, the higher the company’s growth rate compared to a company that does not necessarily have these characteristics.

ServiceNow revenue growth and 26% ROE

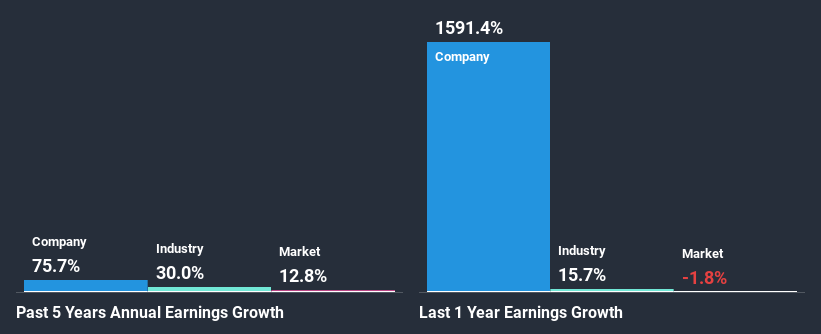

First of all, we like ServiceNow’s ROE is impressive. Second, the comparison with the industry’s reported average return on equity (ROE) of 12% is not something we ignore. In this case, it is expected that ServiceNow’s five-year net income will increase by 76%.

Next, compared with the industry’s net income growth, we found that ServiceNow’s growth is quite high compared to the industry’s average growth of 30% during the same period.

Earnings growth is an important indicator to consider when evaluating stocks. For investors, it is important to know whether the market has factored in the growth (or decline) of the company’s expected earnings. Doing so will help them determine whether the future of the stock is hopeful or ominous. A good indicator of expected earnings growth is the price-to-earnings ratio, which determines the price the market is willing to pay for the stock based on the market’s earnings outlook. Therefore, you may want to check whether ServiceNow is trading with a high P/E or a low P/E relative to its industry.

Can ServiceNow effectively use its retained earnings?

in conclusion

Overall, we think the performance of ServiceNow is quite good. In particular, it is great to see that the company is investing heavily in its business and has achieved high returns, which has led to a considerable increase in its earnings. Having said that, the latest industry analyst forecasts indicate that the company’s earnings growth is expected to slow.To learn more about the company’s future earnings growth forecasts, please view this free Report analyst forecasts about the company to learn more.

Promotion

If you decide to trade ServiceNow, please use the lowest cost* platform, which is rated #1 by Barron’s Interactive Brokers in the overall market. Trade stocks, options, futures, foreign exchange, bonds and funds in 135 markets through a comprehensive account.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stocks, nor does it consider your goals or financial situation. We aim to bring you long-term focused analysis driven by basic data. Please note that our analysis may not consider the latest announcements or qualitative materials from price-sensitive companies. Simply put, Wall Street has no position in any of the stocks mentioned.

*Interactive Brokers named the lowest-cost broker online review 2020 by StockBrokers.com

Have comments on this article? Concerned about the content? keep in touch Contact us directly. Or, send an email to [email protected].

#market #follow #fundamentals #Simply #Wall #news

More from Source