-

The Department of Education is notifying approximately 8 million borrowers who automatically qualify for aid.

-

Those borrowers do not need to apply, but those who wish to opt out must do so by November 14.

-

Those eligible for automatic relief can also choose to submit a form if they want it processed sooner.

Millions of student-loan borrowers don’t need to take any action to get President Joe Biden’s debt cancellation.

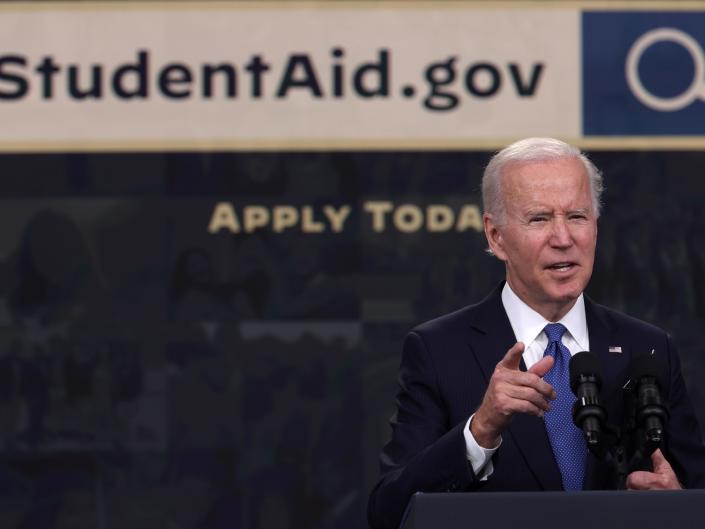

On Monday, Biden and Education Secretary Miguel Cardona formally launched the application for up to $20,000 in student loan forgiveness. It’s a simple form that should take less than five minutes to fill out — borrowers just need to enter basic contact information like their name, email address, and Social Security number. But for about 8 million borrowers, those five minutes could be saved. The Washington Post first reported Tuesday that the Department of Education has begun notifying borrowers that they are eligible to have their loans automatically written off.

Borrowers likely to receive notices are those for whom the department already has income information on file. That usually happens by enrolling on the FAFSA, or federal financial aid form, or by currently enrolling in an income-driven repayment plan that gives borrowers affordable monthly payments based on income that they bring it home.

The department also told the Post that borrowers eligible for automatic relief can choose to opt out of it for any reason, but they must do so by Nov. 14 by contacting their company student loan Failure to do so means that relief will be processed for borrowers after that deadline.

Here’s what that notice will likely look like as, according to one borrower who said he received it this morning.

All other borrowers can apply through a form at studentaid.gov, and the department recommends that they submit those forms by mid-November so that the relief can be processed and applied to borrowers’ accounts. before resuming payments the following year. While it’s unclear how many borrowers will opt out of the program, a lawsuit filed last month by a conservative group argued that an Indiana plaintiff would be stuck with an unwanted tax if the relief were implemented.

But that case was quickly struck down by a judge, and the White House clarified that “anyone who doesn’t want debt relief can choose to opt out.” All borrowers have until December 2023 to apply, and those who qualify for automatic relief can also choose to submit the form now if they want it processed sooner than mid-November.

Read the original article on Business Insider