When you buy and hold a truly great business, long-term investment can change lives. Over the years, we have seen some truly amazing gains. In other words, ServiceNow, Inc. (NYSE: NOW) The stock price has soared 694% in five years. If this does not make you consider long-term investments, we don’t know what will happen. What also pleases shareholders is the 13% earnings in the past three months. We are really happy to see investors’ stock prices perform so well.

Although the market value of ServiceNow has fallen by $8.3 this week, let’s take a look at its long-term fundamental trends and see if they drive returns.

Check out our latest analysis of ServiceNow

We believe that ServiceNow’s meager profits in the past 12 months have not attracted sufficient attention from the market. We think income may be a better guide. Generally speaking, we will consider such stocks together with loss-making companies, simply because the amount of profit is so low. If income does not grow, it is hard to believe that it will be more profitable in the future.

In the past 5 years, ServiceNow’s revenue has grown at an annual rate of 28%. Even compared with other revenue-focused companies, this is a good result. Fortunately, the market did not miss this point. During this time, the stock price increased by 51% every year. It is never too late to start paying attention to top stocks like ServiceNow, because some long-term winners will continue to win for decades. Therefore, we recommend that you study this carefully, but keep in mind that the market seems very optimistic.

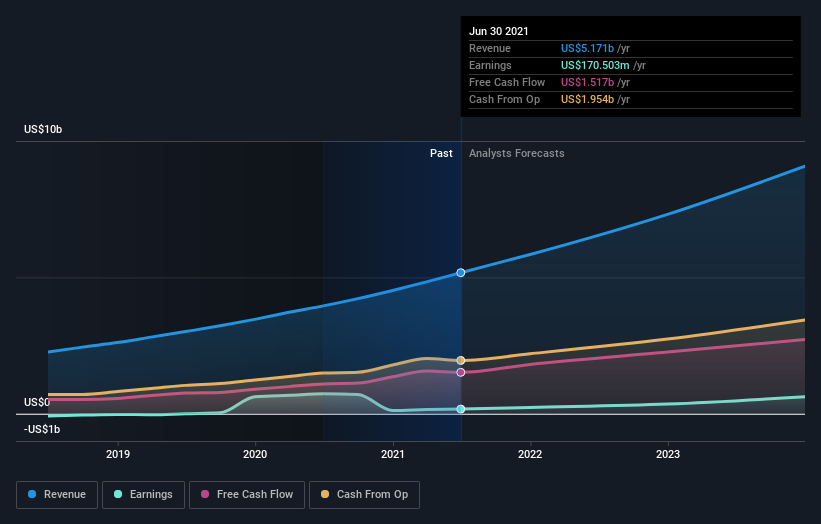

You can see the income and changes in income over time in the graph below (click the graph to see the exact value).

ServiceNow is well known to investors, and many smart analysts try to predict future profit levels.Given that we have quite a lot of analyst forecasts, it might be worth a look free Graphs depicting consensus estimates.

Different perspectives

ServiceNow shareholders received a 26% return in 12 months, which is not far from the general market return. It must be pointed out that recent returns have been below the 51% increase in shareholders’ annual increase over five years. Recently, stock price growth has slowed. But I have to say that the overall situation is one of good long-term and short-term performance. It can be said that this makes ServiceNow a stock to watch. Although it is worth considering the different effects of market conditions on stock prices, there are other factors that are more important.For example, we have determined 4 warning signs for ServiceNow You should know.

If we see some big insiders buying, we will prefer ServiceNow.While we wait, take a look at this free There is a list of growth companies recently purchased by a large number of insiders.

Please note that the market returns quoted in this article reflect the market weighted average return of stocks currently traded on US exchanges.

This article written by Simply Wall St is general in nature. We only use unbiased methods to provide comments based on historical data and analyst forecasts. Our articles are not intended to provide financial advice. It does not constitute a recommendation to buy or sell any stock, nor does it consider your goals or financial situation. We aim to provide you with long-term key analysis driven by basic data. Please note that our analysis may not consider the latest price-sensitive company announcements or qualitative materials. Simply put, Wall Street has no position in any of the stocks mentioned.

Any feedback on this article? Concerned about the content? keep in touch Contact us directly. Or, send an email to the editorial team (at) simplewallst.com.

When trading ServiceNow or any other investment, please use Interactive Brokers, a platform that many consider professionals’ gateway to the world market. You can trade stocks, options, futures, foreign exchange, bonds and funds through a comprehensive account at the lowest cost* worldwide.Promotion

#decline #week #shareholders #ServiceNow #NYSE #risen #years

More from Source