Alphabet Inc., Microsoft Corp. and Texas Instruments Inc. posted double-digit quarterly earnings growth on Tuesday and expressed optimism about the coming months, reassuring investors worried that the technology industry is poised for a bad second quarter half

Shares of all three companies rallied in late trade, boosting S&P 500 futures and giving tech peers a boost. Earnings reports from a trio of industry giants set the tone for a week that will include results from heavy hitters such as Meta Platforms Inc., Qualcomm Inc., Apple Inc., Amazon.com Inc. and Intel Corp.

Microsoft gave an encouraging sales forecast for the current fiscal year, allaying fears that the strong US dollar and a weakening economy would hurt sales. Chip maker Texas Instruments also offered a bullish forecast, indicating that sales and profits this quarter are likely to exceed Wall Street estimates. And Alphabet, the parent company of search giant Google, posted advertising revenue that exceeded analysts’ expectations.

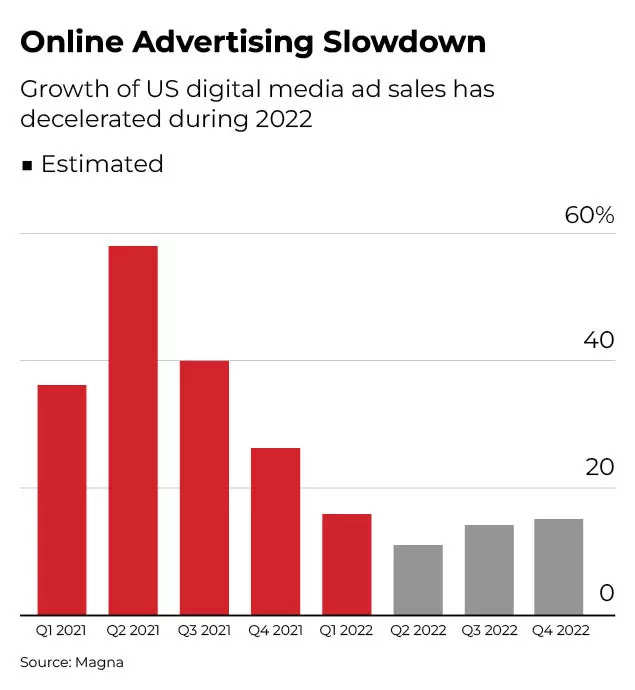

The slowdown in online advertising was a particular concern of investors, which dragged down shares of Snap Inc. and Twitter Inc. following their earnings reports last week.

“I would interpret this report as a sigh of relief,” Dan Morgan, a senior portfolio manager at Synovus Trust Co., said of Alphabet’s results. “You’re looking at an environment where overall ad spending rates are definitely slowing down, but Google has still been able to deliver more and more.”

The three reports reflect the underlying stability, if not outright strength, in four of the industry’s main pillars: digital advertising, cloud computing, information technology spending and chips. However, it’s not all good news. A rising US dollar, which lowers the cost of overseas sales, lowers profits — especially at Microsoft. And Texas Instruments saw weaker demand for chips in consumer products.

Alphabet missed analysts’ estimates for its YouTube and cloud businesses. The company’s earnings also came in: Earnings were USD 1.21 per share, compared to an estimate of USD 1.32.

The companies also pointed to growth constraints looming in the coming months. Advertisers have started to hold back on spending, wary of an uncertain economic environment. Alphabet chief financial officer Ruth Porat used the term “ad pullback” several times in a conference call with analysts. “It’s clear that Google has its work cut out for it in the last half of the year,” said analyst Evelyn Mitchell of Insider Intelligence.

Still, investors were pleased with the overall tone of Google’s remarks. The market for search advertising is more resilient than social media ads, insulating Google’s business relative to competitors like Snap and Facebook.

At Microsoft, the company signed a record number of Azure cloud contracts worth more than USD 100 million and USD 1 billion, CFO Amy Hood said in an interview. Commercial bookings, a measure of future sales to the company’s customers, were “significantly” better than the company had expected, rising 25 percent, an indication that the company’s demand for Microsoft software remained strong. strong in the quarter, Hood added.

Texas Instruments, one of the world’s largest chipmakers, said demand is strong for semiconductors used in industrial machinery and vehicles. It also saw a rebound in China after that country began to lift the country’s Covid-related lockdowns, which closed factories.

South Korean chipmaker SK Hynix Inc. also delivered strong results, helped by the flip side of a strong US dollar. The weak Korean win — combined with resilient demand — contributed to a 56 percent profit gain last quarter. However, the company is cautious about the future, saying it will “carefully” review its 2023 investment plan.

Investors will get deeper insight into the underlying health of digital advertising, chips and IT spending Wednesday, when Meta and Qualcomm and ServiceNow Inc. their latest numbers.

.