Looking at the shareholders of ServiceNow, Inc. (NYSE:NOW) can tell us which group is the most powerful. With a 90% stake, institutions hold the highest share in the company. Put another way, the group faces the highest potential upside (or downside risk).

Last week’s US$3.8b market cap gain is likely to be appreciated by institutional investors, especially after a year of 47% losses.

Let’s take a closer look to see what different types of shareholders can tell us about ServiceNow.

Check out our latest review for ServiceNow

What Does Institutional Ownership Tell Us About Today’s Service?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies included in major indexes.

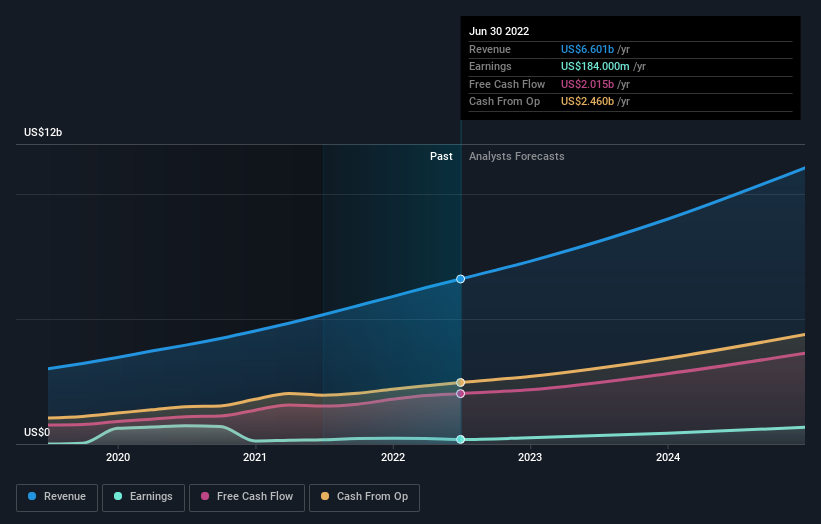

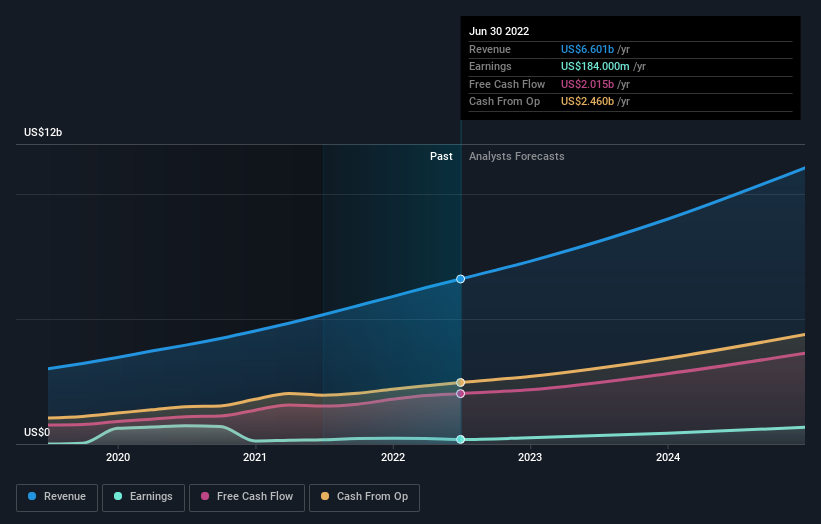

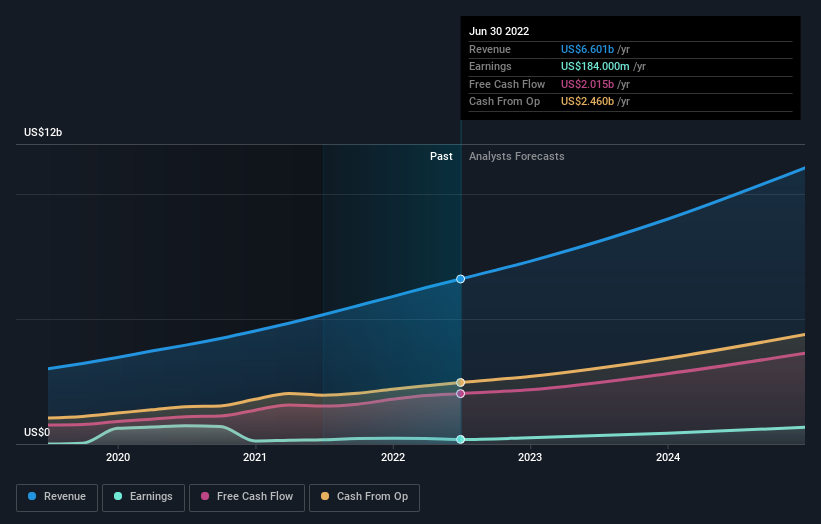

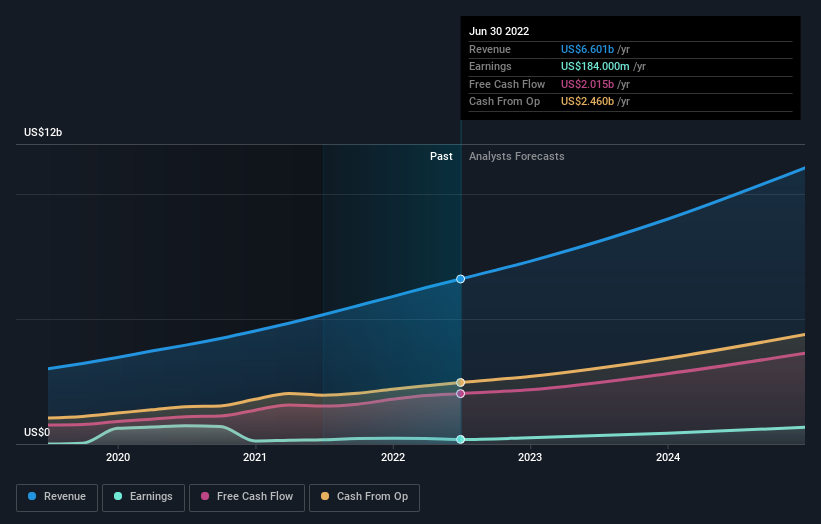

We can see that ServiceNow has institutional investors; and they hold a good portion of the company’s stock. This indicates that the analysts working for those institutions have looked at the stock and they like it. But like anything else, they can make mistakes. It is common to see a large share price drop if two large institutional investors try to sell a stock at the same time. So it’s worth reviewing ServiceNow’s past earnings trajectory, (below). Of course, remember that there are other factors to consider as well.

Institutional investors own more than 50% of the company, so collectively they are more likely to strongly influence board decisions. ServiceNow is not owned by a hedge fund. The Vanguard Group, Inc. is currently the largest shareholder, with 8.2% of the outstanding shares. In comparison, the second and third largest shareholders own 8.0% and 7.0% of the stock.

A closer look at our ownership numbers suggests that the top 20 shareholders have a combined ownership of 51% indicating that no single shareholder has a majority.

Institutional ownership research is a great way to gauge and filter a stock’s expected performance. The same can be achieved by studying analyst sentiments. There are a reasonable number of analysts covering the stock, so it can be useful to know their collective outlook on the future.

Insider Ownership of the Service Now

The definition of an insider may differ slightly between different countries, but members of the board of directors are always counted. The company’s management answers to the board and the latter must represent the interests of the shareholders. Interestingly, sometimes top managers are on the board themselves.

Insider ownership is positive when it indicates that leadership thinks like the real owners of the company. However, high insider ownership can also give enormous power to a small group within the company. This can be negative in some cases.

Our latest data indicates that insiders own less than 1% of ServiceNow, Inc.. Being so large, we would not expect insiders to own a large portion of the stock. Together, they own US$174m of stock. Relatively recent purchases and sales are also important to consider. You can click here to see if insiders are buying or selling.

General Public Ownership

The general public, which is typically individual investors, holds a 10% stake in ServiceNow. Although this ownership may not be large enough for them to influence a policy decision, they can still make a collective impact on company policies.

Next Steps:

While it is worth considering the different groups that own a company, there are other factors that are more important. Be aware that ServiceNow shows 1 caveat in our investment analysis you should know about…

If you prefer to discover what analysts are predicting in terms of future growth, don’t miss this Free report on analyst forecasts.

NB: The figures in this article are calculated using data from the last twelve months, which refers to the 12-month period ending on the last date of the month in which the financial statement is dated. This may not be consistent throughout the year with annual report numbers.

Do you have feedback on this article? Worried about content? Please contact directly to us. Alternatively, email editorial-team (at) simplywallst.com.

This Simply Wall St article is general. We provide commentary based on historical data and analyst forecasts using only an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take into account your goals, or your financial situation. We aim to bring you long-term focused analysis driven by primary data. Note that our review may not factor in the company’s latest price-sensitive or material quality announcements. Simply Wall St has no position in any of the stocks mentioned.

Join a Paid User Research Session

You will receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investment tools for individual investors like you. Sign up here