The environment of rising interest rates has made the Nasdaq Composite COMP,

hard to love last year, but its 22% drop seems to open up opportunities for some.

It brings us to ours call of the dayfrom Chul Chang, a manager at Vontobel’s US Equity Institutional Fund VTUIX,

He said investors are too busy chasing companies that can handle unexpected macro worries, they don’t notice the gems with “mission -critical products” that are well armored for economic collapse.

“We’re looking for strong franchises that we think … can grow in their competition, grow in the market and get into positions where they will be stronger and bigger on the other side of any macro weakness,” he said. Chang told MarketWatch in an interview on Wednesday.

His fund contains staples like Coca-Cola KO,

and leading holding Microsoft MSFT,

As for diamonds in the dust, the manager features Synopsys SNPS,

a maker of software tools for electronic automation design. Investors are getting defensive posturing, a business with a predictive nature and good growth, Chang said.

“The reason why we know through a downside, through an upcycle, that [Synopsys] What will be tough is that they have the high recurring income that mission -critical chip engineers need to do their jobs, ”he said.“ So it’s not a tool you decide to cut because you think the next 12 months are near the recession or higher rates. ”

In 2008 and 2009 when the chip industry was shrinking, Synopsys saw flat revenue and delivered revenues, he said. Shares are down 12% this year.

He also likes ServiceNow NOW,

down 22% so far this year. The software company and its cloud computing platform are the “major players” that corporations use to systemize their workflows.

“Early innings when we’re talking digital transformation, so there’s a lot of future development just from share gains in that one category,” he said. ServiceNow has expanded into operations, employee management and customer service management.

“So again, going back to the theme of being defensive in weak times, this is a company that we think continues to grow not only from the secular trends they see, but simply because of the subscription model and being defensive. of their profile. ,” he said.

Chang’s last choice was Keysight Technologies KEYS,

a leading measurement company with “the widest offerings of equipment for measuring electrical signals or radio signals,” with growth also supported by trends in the sector. Keysight is down 29% this year.

“In this case, 5G, but also what will 5G do for the Internet of Things, or AI or EVs,” he said, noting that Keysight tools are being used to test EV infrastructure, batteries, inverter, so there’s a lot of “rising use that’s just beginning.”

Keysight also sells manufacturing tools, which customers use as they make newer cars, products or smartphones. So those clients see Keysight’s tools as “mission critical” and “won’t be cheap about it,” making it a company “that can deliver, we think double-digit revenue growth in longer time, “he said.

The buzz

Chinese EV maker NIO NIO,

fell in premarket trade as its second quarter earnings guidance was lower than Wall Street estimates, even as it minimized its loss in the first quarter. Chinese ADRs were also forced following a report that the China Securities Regulatory Commission said it was not undertaking work to revive Ant Group’s initial public offering.

Twitter TWTR,

reportedly will offer Elon Musk a data-sharing agreement to fix Tesla TSLA,

chief doubts about bots on social media sites and get the $ 44 billion deal getting ahead.

The European Central Bank meeting is on tap, although few expect a move in rate increases until July as the bloc struggles with inflation that hit a record 8.1% year-over-year in May. Next week will bring meetings of the Fed, Bank of England and Bank of Japan.

Calendar data includes weekly unemployment claims and household net wealth counts for the next day.

Dutch and UK natural gas prices GWM00,

is rising after the Texas explosion for a major liquified natural gas exporter, Freeport. The explosion will cause a shutdown for at least three weeks.

The Shanghai district of Minhang (pop. 2 million) is under strict lockdown and will undergo mass test due to a COVID outbreak. “Markets are naive in pricing because the easing of restrictions in Beijing and Shanghai is the final victory against omicron, and thus, the highest covid-zero,” said Jeffery Halley, senior market analyst at OANDA.

The markets

No credit

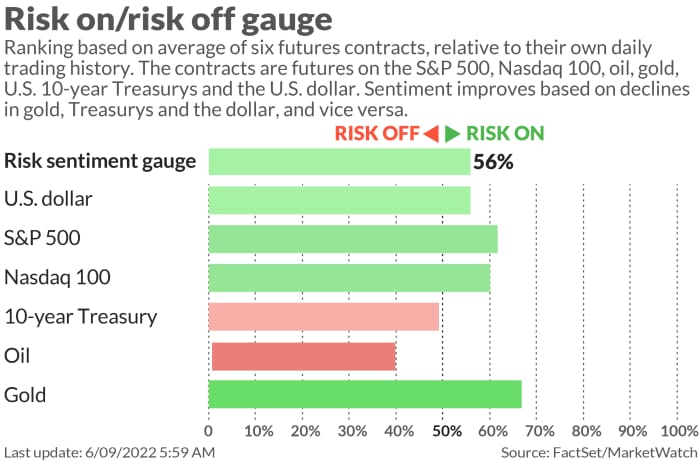

Stock futures ES00,

YM00,

NQ00,

rises, because the bond yields TMUBMUSD10Y,

pull back. Oil price CL.1,

expects $ 121 per barrel, the DXY dollar,

and gold GC00,

is sliding, while bitcoin BTCUSD,

holds at the $ 30,000 level.

Read: Oil prices could be ‘parabolic’, putting the global economy in a ‘critical situation,’ says head of commodity trading giant

The tickers

These are the top traded tickers on MarketWatch starting 6 am Eastern Time:

The chart

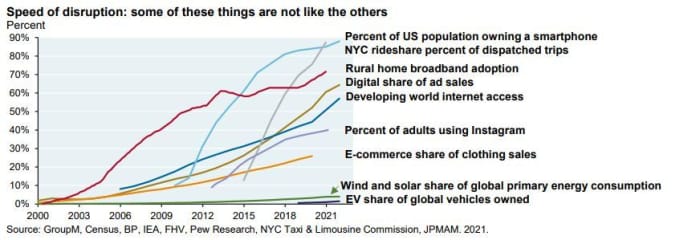

Our chart of the day is from Michael Cembalest, chair of market strategy and investment at JP Morgan Asset Management, who lays out trends in energy transfer. He included a chart showing how disruption has been slower over the past 20 years in some parts of the economy than others. For example, everyone seems to have a smartphone, but fewer people than you think own an electric vehicle.

Random reading

American tourists were fined after throwing a scooter down the stairs of a UNESCO World Heritage site in Rome, causing $ 26,000 in damage.

Late-night talk show host Jimmy Kimmel told President Biden that “he needs to start shouting at people.”

The Tik Tok trend combines sparkling water and balsamic vinegar for the hottest, healthiest new Coke of the summer.

The Need to Know starts early and is updated until the bell rings, but sign up here to have it delivered once to your email box. The emailed version will be sent at about 7:30 am Eastern.

Want more for the next day? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

.