Here’s the exact blueprint you need to follow to pick winning stocks and the next multibagger in a bear market or market correction, with case studies on Lantheus Holdings (LNTH) and ServiceNow (NOW).

Focus on identifying strength in market structure when compared to the S&P 500 (ES) as explained in the video below.

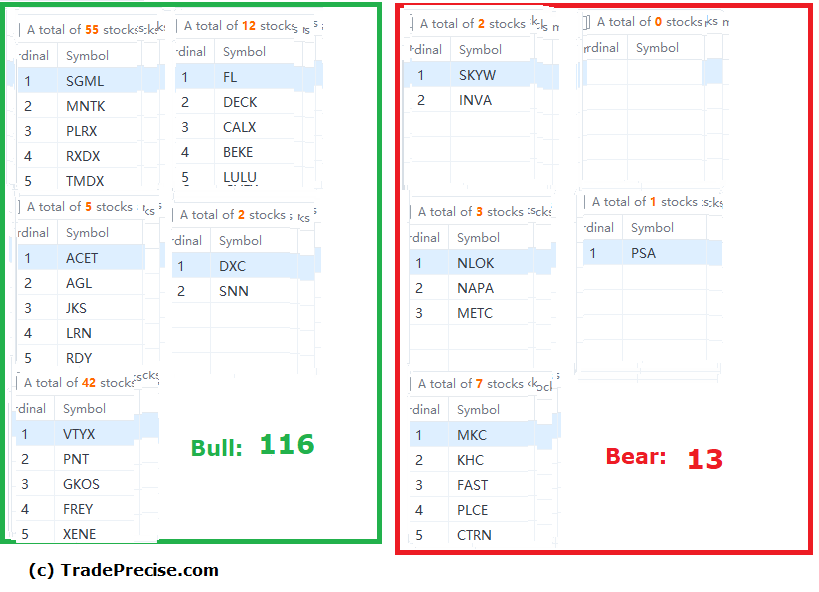

Bullish setup versus bearish setup is 116 to 13 from my stock screener screenshot below.

Picking better stocks in strong sectors like solar, lithium, renewable energy, Biotech and health tech, is the key to thrive in this volatile market. The sharp decline in market breadth suggested a challenging environment in the trading market.

Currently, there are 25 stocks that meet the criteria of market leaders and the characteristics of the accumulation structure as updated in the Weekly live session membership module.

The character bar change triggered by the CPI data came with a supply spike, suggesting more weakness in the S&P 500. The immediate support level at 3900 could be vulnerable. However, the market bottom indicator as shown by the breadth thrust is a valid bullish scenario.