From here, however, things can get tricky. European clients, who typically account for a quarter to a third of Indian companies’ sales, are almost certain to cut their tech budgets — at least until the war in Ukraine ends and business returns to normal. energy supplies. The more important US market may also fail as the Federal Reserve slows the economy to tame inflation.

Some American companies may still look to information technology to cut costs as they look for a recession. That means new outsourcing orders. However, the pandemic-era IT splurge is now in the rearview mirror for Indian vendors. Coders who could easily get by during the Covid-19 lockdowns are becoming restless with the lack of career advancement since the reopening of the global economy. The attrition rate of TCS last quarter was more than 21%.

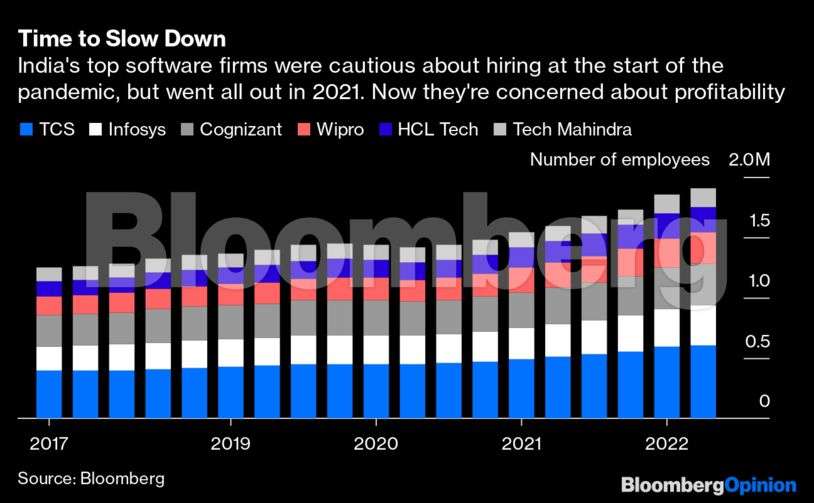

These were all passing problems for an industry that came into its own at the turn of the millennium — the Y2K bug put India on the technology services world map. Two decades later, India’s public software exporters have earned more than $100 billion in revenue, employ 2 million people and have a market capitalization of nearly $350 billion. Only TCS is more valuable than International Business Machines Corp.

But size comes at the expense of agility. The outsourcing industry is all about helping global companies reduce friction at work, something consulting firms have been doing better of late.

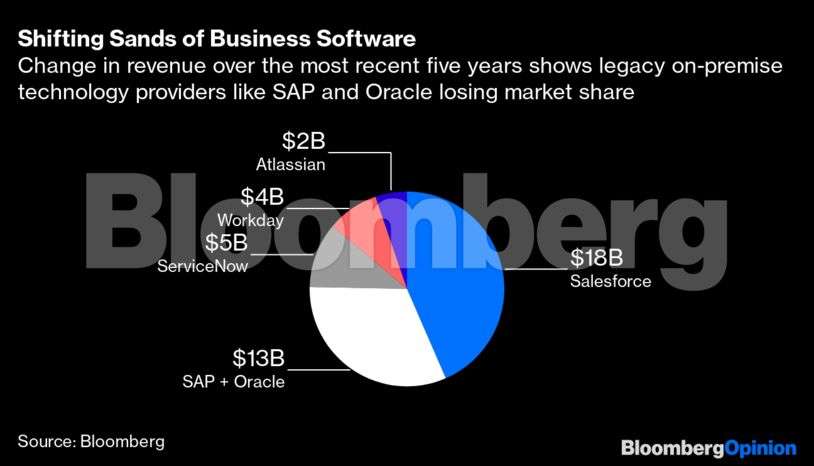

Strictly managed from headquarters in Mumbai or Bengaluru, Indian IT firms still have a strong labor cost advantage when it comes to large-scale enterprise software. The locus of demand, however, is moving away from the implementation of technologies from SAP SE or Oracle Corp. at the clients place. Demand for cloud-based workflow automation has seen ServiceNow Inc.’s revenue increase. six times since 2015, while sales at Atlassian Corp. based in San Francisco increased eightfold thanks to Jira, a cloud-based application for tracking projects.

Fast-growing German startup Celonis SE, a pioneer in so-called process mining, says it helps customers “fix inefficiencies they can’t see.” Salesforce Inc., which owns the business productivity tool Slack, had a third of SAP’s revenue in 2017. Now it’s just 12% smaller. Shopify Inc. ordered. a 19% share last year in digital-commerce software, versus Oracle’s 6%, according to Bloomberg Intelligence.

In implementing new-age IT platforms, Indian outsourcing players are lagging behind the likes of Accenture Plc and Deloitte Consulting.

In 2015, Accenture acquired Cloud Sherpas, a small outfit of 1,100 employees of which 500 are Salesforce implementation consultants. Seven years later, the cloud is a $26 billion business for Accenture, growing at 48% annually. Indian outsourcing companies have also ramped up cloud-based offerings, but they’ve struggled to build scale with popular new technologies like the human-resource management system offered by Workday Inc.

Tech is now a big part of what consulting firms do. That’s why they get to the nuts and bolts of their clients’ operations – or at least strengthen their ability to do so. McKinsey & Co., which in recent years has acquired more than 20 technology-related companies, hired Jacky Wright, former chief digital officer of Microsoft Corp., as its first chief technology and platform officer in last month Deloitte is aggressively recruiting coders and investing in training them in new technologies.

As the line between business and technology blurs among global corporations, Indian software vendors risk falling further behind their consulting rivals. Outsourcing companies are comfortable talking with in-house tech czars to large corporate clients. But when it comes to deciding priorities, functional heads increasingly call the shots. And they don’t speak the language of tech. A related trend is the rise of citizen developers — non-IT professionals building automation applications for their teams using so-called low-code platforms such as Appian.

Mind you, the implementation of Salesforce and Workday may not offer a ticket out of a global recession next year: New IT players are also worried about demand. But at least they’re more plugged into the future of work — flexible, digital and often remote — than their traditional enterprise-software rivals. India’s leading outsourcing companies should now have built billion dollar franchises around the implementation of newer platforms. To get back in the game, they will need fat acquisitions and a hard look at the state of employment at their own companies, starting with fresher salaries that have been stuck for nearly two decades at around 350,000 rupees ($4,250) a year.

Mint reported last week that entry-level positions in India’s IT industry could be cut by 20% in the fiscal year that begins next April. That could give outsourcing companies some breathing room in profit margins. But focusing too much on the current slowdown can be unhealthy. This is the future they must face — and make bold bets.