Whenever a company announces a stock split, we hear the same chorus of voices moaning that splits make no sense for shareholders.

But in fact, they do.

What detractors mean is that when a company splits stock, it has the same price-to-earnings (P/E) valuation and the same earnings per market cap. The fundamentals of the company do not change.

Technically, they are right. But stocks are driven more by the cold logic of detractors. History shows that stock splits yield outperformance – both immediately and for up to a year. So I want to see them in the names I suggest in my stock letter (the link is in my bio, below).

Here are some recent examples showing near-term pop:

Tesla TSLA,

announced before the market opened on March 28 that it intended to create a stock split. Since Friday’s close, the stock has grown 8.8% at the end of March 29, compared to 3.2% for the Nasdaq COMP,

and 1.9% for the S&P 500 SPX,

If that’s “nothing,” I’ll take it.

Amazon.com AMZN,

announced a 20: 1 stock split on March 9. On March 29, the stock was up 21.5%, compared to 10.3% for the Nasdaq and 8.3% for the S&P 500. This split will take effect on June 3.

* Alphabet GOOG,

announced 20: 1 stock split Feb. 1. Its stock is up 8.3% compared to 3.5% for the Nasdaq and 1.9% for the S&P 500. The spit will take effect on July 15th.

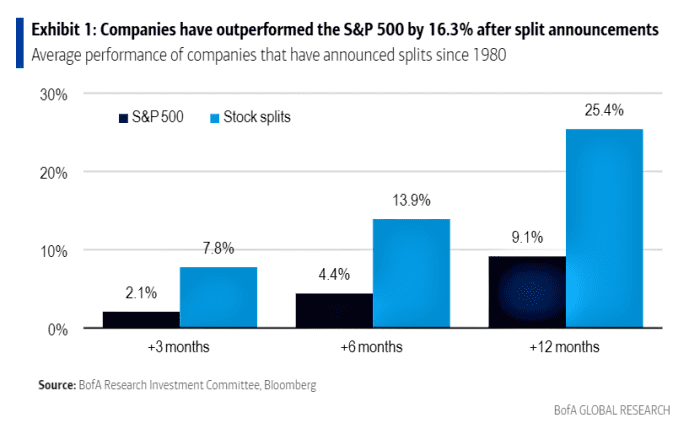

These aren’t just weird examples – and the effect lasts longer than a few weeks. Since 1980, the shares of companies doing stock splits have typically risen 25% a year later, compared to 9% for the broader market, according to a recent Bank of America study. They also exceeded three and six months, as you can see in this chart.

Why split stocks are better

There are two reasons why stocks’ performance is split:

1. Investors view stock splits as a sign of management confidence. This is not off-base, as splits happen more often in stocks that have bullish momentum behind them. That momentum is often caused by strong trends within companies. The momentum just continues, post-split.

“Companies announcing splits typically see sustained outperformance in the market and expect the outperformance to continue,” Bank of America said. “The company’s underlying strength is a major driver of high prices.”

2. Splits increase liquidity by making shares more accessible to a wider range of investors, something Amazon recognized when it announced its split. After the split, its stock will go to approximately $ 170 per share instead of $ 3,386. Not everyone has a brokerage account that offers partial share purchases, although they are becoming more common. Even the serene Vanguard will announce it as an option shortly, says a source within the company.

Not all splits are equal

Performance is not always positive after split. Stocks see negative returns about 30% of the time after 12 months. But gains are more common and greater than losses, on average.

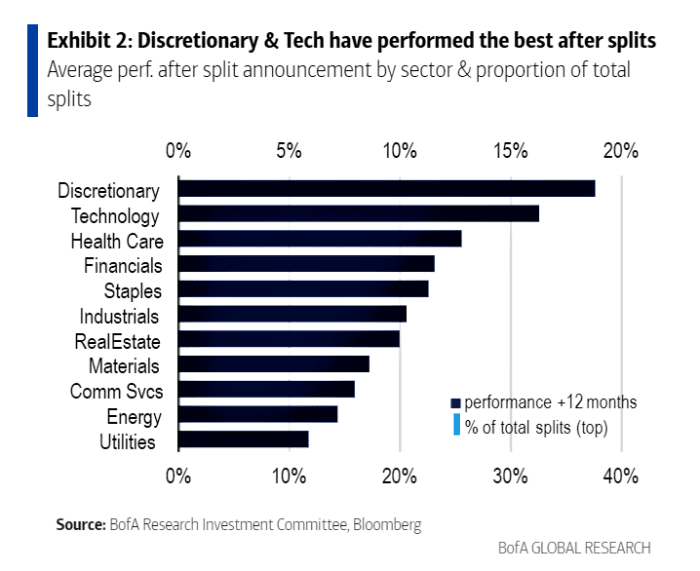

If you want to tilt your portfolio toward stocks that can get a rise from a stock split announcement, use these tactics. First, go with names with high stock prices, of course, over $ 500. Next, favor names in consumer discretionary, tech and healthcare, where splits precede the best results. Gains for these groups averaged 26% –38% in the 12 months after the split announcement. That’s probably because these are sectors of growth and momentum.

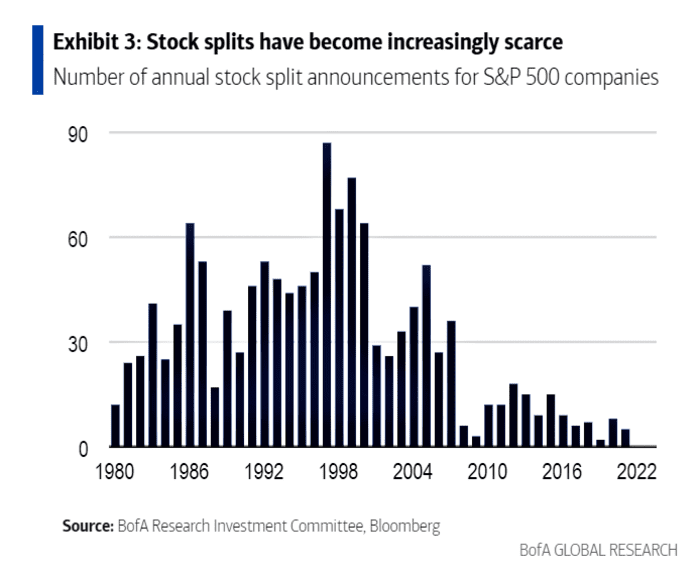

Unfortunately, stock split announcements have become rare over the past decade. There have been only 28 stock splits in the past five years compared to 346 in 1996-2000.

But that could change. The recent market rewards for split announcements at high-profile companies like Amazon, Alphabet and Tesla could entice other companies and spark a wave of splits, says Bank of America’s Justin Post. Because splits attract inflows and support prices, they may be better for companies than the more expensive share buyback.

Five stock-split candidates

Aside from owning Tesla, Amazon.com and Alphabet for more outperformance in the future, as their recent stock split news suggests, consider owning or watch these names for a potential split news. They all have high stock prices, good growth, decent stock price momentum and buy ratings from Bank of America.

NVR: One of the largest homebuilder in the US, NVR NVR,

makes single-family detached homes, townhomes and condominiums. NVR also has a mortgage-banking and title-services business. I have included recent or projected sales and revenue trends, to show the growth angle.

NVR posted 19% revenue last year to $ 8.95 billion, and a 37% increase in net revenue to $ 1.24 billion. Although interest rates are rising, demand for homes should remain strong due to confined demand and lack of supply. NVR stock is trading for a split-worthy $ 4,748 per share.

Booking Holdings: This online-travel company helps its customers book flights, hotels, restaurants, cruises, tours and car rentals. BKNG booking,

is known for its user-friendly website and search features. It works under the brands Booking.com, Priceline, Agoda, Rentalcars.com, Kayak and OpenTable. All of this makes Booking the game reopening as Covid continues to shrink, which I think will happen.

Fourth-quarter gross travel bookings grew 160% compared to last year, to $ 19 billion. Revenue grew 141% to $ 3 billion, and net income per share was $ 14.94, compared to net loss per diluted portion of $ 4.02 last year. The booking stock seemed ripe for split, as it reached approximately $ 2,370.

TransDigm: This company designs and sells highly engineered proprietary aircraft parts to aircraft manufacturers and airlines. It does a huge amount of recurring, aftermarket business on replacement parts. TransDigm TDG,

usually sells higher margin special parts such as motors, batteries, power control and cockpit systems.

The company posted 8% sales growth in the first quarter, to $ 1.2 billion. Net revenue from resumption of operations grew 226% to $ 163 million, and it posted earnings per share of $ 1.96 compared to a loss of 42 cents per share last year. Like Bookings, this is a re -opening of the game due to its exposure to the airline sector. At $ 684 per share, TransDigm’s stock looks ready for split.

Lam Research: This company provides wafer manufacturing equipment and related services to the semiconductor industry. Its products help chip makers build smartphones, personal computers, servers, wearables, cars and better-performing data storage devices.

Lam Research LRCX,

reported a 2% decrease in sales to $ 4.23 billion in the fourth quarter and diluted revenue per share rose only 2% to $ 8.44. Like most companies in the chip space, this one has been plagued by supply-chain issues.

But those will be fixed, which will put Lam Research back on the path of growth. “We expect wafer-fabrication-equipment investment to increase again in calendar year 2022, leading to another strong year of growth for Lam,” CEO Tim Archer said when the company announced earnings in January. The stock could use a split, as it goes to $ 569.

Service Today: This company’s Now Platform helps companies, universities and governments work more efficiently by digitizing their workflows.

ServiceNow’s NOW,

sales grew 29% last year to $ 5.9 billion, but revenues per share grew only 2.5% to $ 6.07, as the company continued to plow money back into the business. ServiceNow expects annual sales to increase by at least 20.5% over the next five years, reaching more than $ 15 billion by 2026. Its stock seems to have split, as it trades at $ 598 per share.

Although these companies did not split their shares, the stocks stood well due to bullish end-market trends.

Michael Brush is a columnist for MarketWatch. At the time of publication, he owned TSLA, GOOGL and AMZN. Brush suggested TSLA, GOOGL, AMZN NVR, TDG and NOW in his stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks.

.