This email was stolen from the mailbox of General Colin Powell, who was in the Bush administration, and now serves on the Salesforce board. This list, dated May 17th, shows that the publisher is looking for solutions to enhance its current offer, is looking for diversification related to its core business, and-most interestingly-it is targeting entirely new markets. for him.

ServiceNow, Salesforce’s priority after Demandware

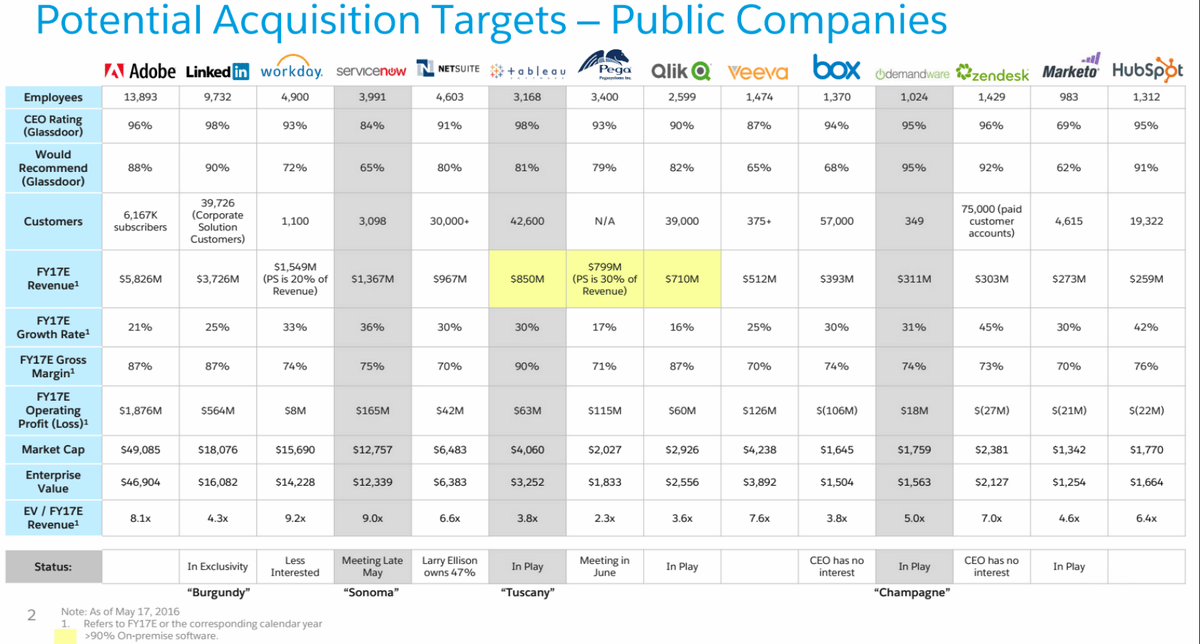

The file consists of three parts. The first table is a table of different IT participants analyzed by Salesforce from the perspective of potential buyers.

However, this list does not mean that he really wants to contact these companies (once or once). On the other hand, it shows the most reliable strategic choice based on the board of directors (see below).

Of these 14 names, 3 are more than just options. They are intentions (as shown in Part 3).

In other words, in Part 1, Salesforce compared their actual purchase intentions- Demandware, Tableau Software, ServiceNow -From a strategic perspective, alternatives can be envisaged to better determine its options.

Part 2 lists competitors that may interfere with these acquisition attempts. There are big names in IT, such as Microsoft, Oracle, SAP or HPE through Google and Amazon. Adobe is listed in both Part 1 (Target) and Part 2 (“Intruder”).

The table emptily shows that Salesforce no longer just sees itself as a CRM competitor, but as platform This is its cross sword against the development of Facebook and even Apple, which has strong financial strength.

The most interesting thing here is of course the confirmation of the increase in power. Chinese. The Salesforce board believes that now, in an acquisition project, we must consider Tencent, Baidu and Alibaba in the top 13 that prevents people from moving around-so please pay close attention to them to avoid losses. Strategic assets under the nose.

Part 3 (over 50 pages in total) details the three buyout plans actually considered by Salesforce.

It includes: target positioning, code names, details of the offer, growth prospects, composition of top management, financial and stock market results (which will affect potential repurchase prices), and analysis of advantages and disadvantages.

Some elements were also found in the tables of these subsections. These elements do not have any doubts about Salesforce’s intentions. These tables return to the “pros and cons” and the synergy of each acquisition, and propose proposals to shareholders (different from market Price) and analyze the financial impact on Salesforce accounts (alias “Diamond” in some tables).

For Demandware, this part is done by Bank of America/Merill Lynch. For ServiceNow from Goldman Sachs. The two orders placed to “service providers”-always getting paid for their services-indicate that Salesforce wants to use these two names more strongly.

The software on demand is eventually acquired by the publisher. The problem now is to know when the publisher started its “Sonoma” project, codenamed ServiceNow.

Furthermore, where is the discussion with Tableau?

Finally confirm Salesforce’s true interest in these three publishers: the document (p4) actually contains the fourth part in graphic form. The graph compares the changes in the share prices of these three companies (from 10% to 60% in May…equal: good deals) and Salesforce (+6%) over the past 12 months.

But let’s return to other objectives regarding the long-term strategy of Mark Benioff and his board.

Rebar

Type 1 companies that have studied acquisitions: experts Customer relationship management (Salesforce’s sales cloud and service cloud).

We found HubSpot, ZenDesk (new company for SaaS solutions for call centers) (recently acquired French company BIME to consolidate its reporting/analysis section), and Veeva (founded in 2007 to focus on “life sciences”. health It is a thriving IT department, let us remember. This obviously interests the publisher.

In the form published by the Wall Street Journal, none of these companies had any specific comments, indicating that the choice to strengthen internal CRM was purely formal.

The second type of possible reinforcement: actors Marketing automation (Marketing Cloud within Salesforce)

The big name for media retention is obviously Adobe. But the price of the stock market ($46 billion) and lack of comment suggest that this choice is unlikely. Especially because Adobe and Microsoft have established a very close relationship between infrastructure (Adobe on Azure) and IT marketing tools (Adobe connects to Dynamics 365).

In fact, the real target is Marketo. In order to seek financial partners to continue to grow, the leader of SaaS marketing operations and customer engagement automation has a status of “in progress” (“in progress”, which means “may”) in the following table. Part 1 of Salesforce Advanced Management. Yes, but here, Marketo was acquired by the private fund Vista Equity Partners for $1.79 billion in June.

The third type of reinforcement: cooperating. There, the discussion was shortened. Box attracted people’s attention, but “CEO is not interested in it.” Too bad, Salesforce contacted Quip, the purpose is not to obtain a word processing program as an advanced tool for sharing documents, which is essential for business activities and CRM.

Salesforce (also) wants Tableau

The fourth category: analysis. It’s no secret that Wave-now Cloud Analytics-asks a lot of questions. As AI and predictability (via Salesforce Einstein) become more and more important, this is critical to the publisher’s strategy. This explains the redemption greed of Marc Benioff (recently Krux) in this area, where the value of algorithms, automation and simplification tools exceeds the sum of gold and oil. .

On the hunting board, we found Qlik and board. Both are “playing”. But Qlik also sold to an investment fund in June to free up time for Cloud transformation. For Salesforce, there will not be too many regrets a priori, because the preferred target is Tableau.

Two indicators in Part 1 illustrate this: Tableau is in the gray column (like Demandware), and most importantly, it has the code name (vineyard name) of the project developed in Part 3 (like Demandware) .

Of course, Demandware is “Champagne” and Tableau is the “only” Tuscan wine. But all the same, it is not vinegar.

As Tableau’s stock price fell in February 2016 (and some even said it crashed), the issuer’s price was almost halved. With a market valuation of $3.5 billion, Salesforce’s acquisition of Tableau is a “cheap” possibility, far from outdated.

Even if the BI as a service expert’s revenue is 90% of “on-premises”, the logic of “transition to subscription” (page 36 of the document) will not disappoint Salesforce.

From a broader perspective, all these “reinforcement” options indicate that publishers plan to fight back against their direct competitors before they become too important. And it can still find some weaknesses or deficiencies in its historical quotes.

Related diversification

On a global scale-not only on the product-Salesforce has also analyzed its shortcomings. Third, as part of related diversification investments, loopholes in repurchase may be filled soon.

The first name that jumps out here is Demandware.The transaction is complete and allows Salesforce to E-commerce. The foundation of the publisher’s new “business cloud” is Demandware (codenamed “Champagne”), a major player in the industry.

Another name that can be compared to vineyards: LinkedIn (“Burgundy”).Professional social network is indeed a data source Unique to CRM. However, the very strategic transaction was conducted by Microsoft, which annoyed Marc Benioff.

Rest PegaSystems.Traditional actors BPM According to reports, he is an expert in CRM and marketing automation and met with Salesforce in June. The challenge of its transformation is to adapt to the cloud. Integration into Salesforce may make a lot of sense. But there are also many overlaps. For Salesforce, the main thing is to get one of the most powerful BPM in the market, which is easy to provide to customers.

The problem is that the Pega board did a good job, and the action (and therefore the price) reached the highest level in history. Nevertheless, this is still what Mark Benioff can afford ($2.3 billion). In contrast to this option, Pega is not grayed out, and almost all revenue comes from the scene. However, Salesforce urgently needs to diversify (or enhance) workflow management tools.

New Vision: Towards a Global Platform

For the last lesson on confidential documents, Salesforce looks at ERP (Netsuite and Workday)-ironically, when you think the company has succeeded by adjudicating co-hosts in the CRM bricks of ERP-especially for IT service management.

For ERP, the perspective drawing must be qualified (no ash column, no vineyard). “Not interested” is even written in black and white in Workday. As for NetSuite, Cloud ERP has been acquired by Oracle. In any case, NetSuite’s major shareholder Oracle CTO Larry Ellison (Larry Ellison) is Marc Benioff’s worst enemy.

But considering this simple fact-just like the BPM option-confirms that Salesforce “is transitioning from a leader position in CRM to a position as a global business platform provider,” dixit Nick Mayes, an analyst at PAC/CXP, conducts research.

From the perspective of the same platform, the clearest intention for ITSM is still. The financial analysis of the impact of the acquisition is marked with red letters as “highly confidential”. All of ServiceNow.

It must be said that ServiceNow is a member of the cloud computing platform. It has established itself in fully growing and diversified business areas (such as Salesforce) (such as Salesforce) and industries that target more and more transactions (such as Salesforce). SaaS model. Sales force.

For the record, the vineyard chosen by Marc Benioff for ServiceNow-“Sonoma”-is a cautious area in California that produces better wines than Napa Valley. More diverse. In the next few years, its wines will be no less than its neighbors, and its wines will surpass them. The metaphor of wine is thus perfectly distilled. But the price of the ServiceNow bottle is still $13 billion.Minimum requirements

#Salesforce #requires #ServiceNow

More from Source