Investment thesis

ServiceNow (NOW) is a digital workflow company and shows no signs of slowing down. Even in this very difficult environment, the company is facing near-term uncertainty and reducing its IT infrastructure spending, ServiceNow continues to work hard.

The price of the stock is 17 times its 2021 sales, which is not expensive in the current market, especially for those with such a high gross profit margin, steadily exceeding the 40 rule threshold and continuing to maintain their revenue growth very close to 30% In company terms y/y.

Revenues still maintain strong growth

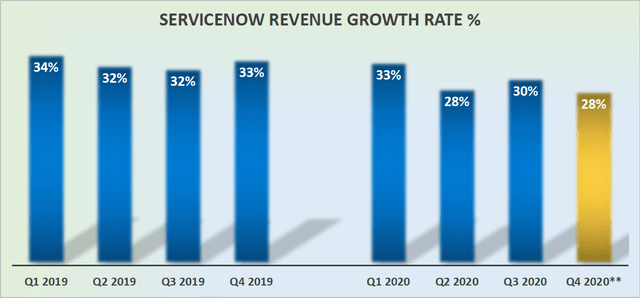

Source: Author’s calculations, **company guidance

ServiceNow has maintained an annual revenue growth rate very close to 30%.

Even now Despite its large size, ServiceNow shows no signs of slowing down. When the current CEO, John Donahoe, resigned, and CEO Bill McDermott took over ServiceNow’s rule, I think McDermott will be unmatched: error Is it me? The picture above clearly shows McDermott’s outstanding performance.

In addition, we can clearly see from the above that during the second quarter of 2020 and the third quarter of 2020, there will be no “pull” growth in revenue, because the guiding principle is expected to continue to maintain approximately 28% in the next quarter. %s level.

Secondly, to my surprise, many companies report a decline in IT spending. I firmly believe that ServiceNow’s digital workflow will also experience a certain degree of demand slowdown. After all, those companies that had to adapt or die had already adapted as early as the second quarter/third quarter. At the same time, in this environment, those who cannot migrate to digital workflows may now be slow.

however, Non-GAAP accounts for the fourth quarter of 2020 point to 25%-26%, Once again clearly stated that even though ServiceNow has many reasons to start to slow down, it is clearly not the case.

Rule of 40?Ticking

Looking forward to the fourth quarter of 2020, ServiceNow has well balanced growth and profitability, with its 40 rule reaching 50%.

Incidentally, when McDermott was promoted to the position and argued that ServiceNow is watching $10 billion in revenue, I think this is just the company’s speech, and this potential is too far away.But now, it becomes very easy to see because ServiceNow may reach $6 billion in revenue in 2021.

Valuation-not unreasonable in this market environment

To repeat, I used to have a lot of trouble solving ServiceNow’s valuation. I missed a meaningful opportunity. Nevertheless, looking to the future, I no longer think that ServiceNow is as expensive as I used to charge.

Assuming ServiceNow slows down its growth rate to 2021, this is a realistic assumption.If we assume ServiceNow’s 2021 revenue growth rate is at the level of 25% revenue growth rate, which will make the stock’s trading price less than 17 times its forward revenue.

If we step back and compare with other companies in this field, there will usually be one or two cheaper companies, such as Salesforce (CRM), whose transaction price is less than 9 times its 2021 forward revenue, although we should note that Salesforce rarely trades at multiples higher than this.

On the other hand, we have companies such as Coupa (COUP) and DocuSign (DOCU), and although their growth rates have only accelerated slightly, their prices are 21 times higher than in 2021 and 2016, respectively.

But this is the current problem in the entire SaaS space: many of these companies have very similar pricing and very similar transactions. If technology is not popular, as it is now, I’m not sure if paying these multiples will bring benefits to investors.

Having said that, ServiceNow’s subscription business is one of the highest gross profit margins in the field. The non-GAAP gross profit margin for the third quarter of 2020 is 86% and provides guidance for the full year.

Bottom line

In the past, I thought ServiceNow was overpriced. Although I have not fully completed the turn and bought long stocks, for many reasons, the stocks still have plenty of room to rise, and I became the focus of attention.

In addition, I proved that investors did not pay too much for ServiceNow’s stock. In general, the name may have positive risk/reward.

Strong investment potential

My market highlights a combination of undervalued investment opportunities-stocks with rapid growth potential driven by top quality management, and these stocks are very cheap.

I follow countless companies, Choose the most attractive investment for you. I will do all the work of selecting the most attractive and profitable businesses.

Easy investment

As an experienced professional, I emphasize Best stock Increase your savings: stocks that can bring strong returns.

- Honest and reliable service.

- Provide handheld services.

- A very simple explanation of stock options. help you Make the most of investment.

- Useful suggestions and videos.

Disclosure: I/we did not mention any stock positions, nor did I plan to initiate any positions within the next 72 hours. I wrote this article myself and expressed my opinion. I have not received any compensation (except for seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

#ServiceNow #strong #growth #cheap #NYSENOW

More from Source