Some people say that volatility rather than debt is the best way for investors to consider risk, but Warren Buffett famously said that “volatility is far from a synonym for risk.” When we consider how risky a company is, we always like to look at its debt usage, because debt overload can lead to bankruptcy.We can see that ServiceNow, Inc. (NYSE: NOW) does use debt in its business. But the real question is whether this debt will put the company at risk.

When is debt dangerous?

When companies cannot easily fulfill these obligations through free cash flow or raising funds at attractive prices, debt and other liabilities become corporate risks. If things get really bad, the lender can control the business. However, a more frequent (but still costly) situation is that companies must issue shares at low prices to permanently dilute shareholders’ equity to support their balance sheets. That being said, the most common scenario is that the company manages its debt reasonably-and in its own benefit. When considering how much debt a company uses, the first thing to do is to put its cash and debt together.

View our latest analysis of ServiceNow

How much debt does ServiceNow bear?

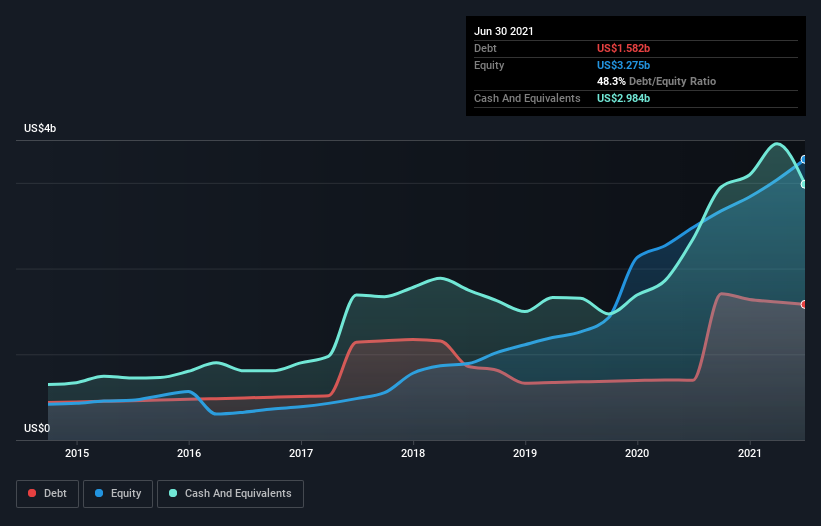

You can click on the image below to view historical data, but it shows that ServiceNow’s debt as of June 2021 was US$158 million, an increase from US$696.1 million in more than a year. But on the other hand, it also has US$2.98b in cash, resulting in a net cash position of US$1.40b.

How strong is ServiceNow’s balance sheet?

According to the last reported balance sheet, ServiceNow’s liabilities due within 12 months are USD 3.91b, and liabilities due after 12 months are USD 2.00b. To offset this, it has $2.98 billion in cash and $781 million in accounts receivable due within 12 months. As a result, its total liabilities exceed the sum of its cash and recent accounts receivable by $215 million.

This situation shows that ServiceNow’s balance sheet looks quite robust, because its total liabilities are almost equal to its current assets. Therefore, although it is hard to imagine that this $129.2b company is struggling with cash, we still think it is worth monitoring its balance sheet. Despite notable liabilities, ServiceNow has net cash, so it can be said that it does not have a heavy debt burden!

Equally good is that ServiceNow’s EBIT increased by 19% last year, further improving its ability to manage debt. When analyzing debt levels, the balance sheet is the obvious starting point. But most importantly, future earnings will determine ServiceNow’s ability to maintain a healthy balance sheet in the future. Therefore, if you want to know what professionals think, you may find this free report on analyst profit forecasts very interesting.

But our final consideration is also important, because the company cannot use book profits to repay debt; it needs hard cash. ServiceNow may have net cash on its balance sheet, but it is still interesting to see how the company converts its earnings before interest and taxes (EBIT) into free cash flow, as this will affect its needs and ability to manage debt. To the delight of all shareholders, ServiceNow has actually generated more free cash flow than EBIT in the past two years. There is nothing better than receiving cash when it comes to gaining the favor of lenders.

Add up

We can understand whether investors are worried about ServiceNow’s liabilities, but we can rest assured that it has $1.40 in net cash. Most importantly, the conversion of 605% of EBIT into free cash flow brings in $1.5b. So is ServiceNow’s debt at risk? In our opinion, this is not the case. The balance sheet is obviously the area you want to focus on when analyzing debt. But in the end, every company can include risks that exist outside the balance sheet.Typical case: we found 5 warning signs for ServiceNow You should know.

If you are interested in investing in a business that can increase profits without a debt burden, please check this free List of growing companies with net cash on the balance sheet.

If you decide to trade ServiceNow, please use the lowest cost* platform rated by Barron’s, Interactive Brokers as the number one overall. Trade stocks, options, futures, foreign exchange, bonds and funds in 135 markets, all from a single integrated account. Promotion

This article written by Simply Wall St is general in nature. We only use unbiased methods to provide comments based on historical data and analyst forecasts. Our articles are not intended to provide financial advice. It does not constitute a recommendation to buy or sell any stocks, nor does it consider your goals or financial situation. We aim to provide you with long-term key analysis driven by basic data. Please note that our analysis may not consider the latest price-sensitive company announcements or qualitative materials. Simply put, Wall Street has no position in any of the stocks mentioned.

*Interactive Brokers was named by StockBrokers.com the lowest-cost broker in online reviews of the year 2020

Any feedback on this article? Concerned about the content? keep in touch Contact us directly. Or, send an email to the editorial team (at) simplewallst.com.

#ServiceNow #NYSE #easily #debt

More from Source