Buying shares in the best businesses can build significant wealth for you and your family. Although it is difficult to find the best companies, but they can generate huge profits in the long run. For example, the ServiceNow, Inc. (NYSE: NOW) the share price has risen 584% over the past half decade, a good profit for long -term holders. And this is just one example of the epic gains achieved by some long term investors. It was even up 13% last week. But this could be related to the buoyant market rising by approximately 6.8% in a week. Anyone holding up for that worthwhile trip is likely to enthusiastically discuss it.

Behind a solid 7-day performance, let’s take a look at what role the company’s fundamentals play in driving long-term shareholder return.

Check out our latest review for ServiceNow

Since ServiceNow has earned little in the past twelve months, we will focus on revenue to measure its business growth. In general, we would consider a stock like this among companies that are losing money, simply because of the very low volume of profits. It’s hard to believe in a more profitable future without growing profits.

Over the past 5 years, ServiceNow has seen its revenue grow by 27% per year. Even when measured against other revenue -focused companies, that’s a good result. Fortunately, the market didn’t miss it, and pushed the share price by 47% per year at the time. Despite the strong run, top performers like ServiceNow are known to have consistently won over the decades. On its face, it seemed like a good opportunity, even though we noticed that the emotion seemed to be positive already.

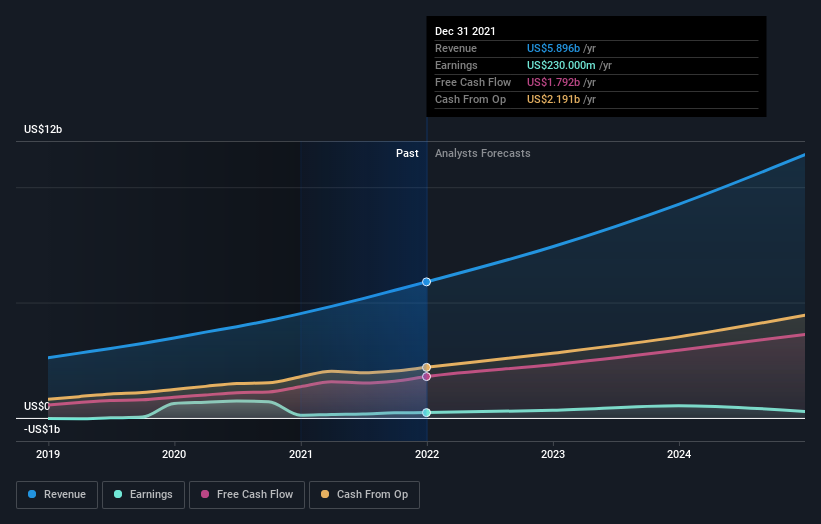

You can see how revenues and earnings have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made large purchases in the past year. However, future earnings will be more important if current shareholders are profitable. This Free The report showing the analyst’s predictions should help you build a view on ServiceNow

A Different Perspective

It is interesting to see that ServiceNow shareholders have received a total shareholder return of 23% in the past year. With that said, a five -year TSR of 47% a year, is even better. The pessimistic view is that the stock has the best days behind it, but otherwise the price may only moderate as the business itself continues to function. While it is worth considering the various effects of market conditions on the share price, there are other factors that are more important. To that end, you should know 1 warning we found in ServiceNow.

There are many other companies with insiders that buy shares. You probably do hindi wants to miss it Free list of growing companies bought by insiders.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks currently trading on U.S. exchanges.

Do you have feedback on this article? Worried about content? Please contact directly to us. Alternatively, email editorial-team (at) simplywallst.com.

This Simply Wall St article is general. We provide commentary based on historical data and analyst predictions using only an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take into account your goals, or your financial situation. We aim to bring you long -term focused analysis driven by core data. Note that our review may not be a factor in the latest company announcements that are sensitive to price or material quality. Simply Wall St does not have a position on any of the stocks mentioned.