The completion of the Celgene acquisition tomorrow and the disappearance of shares in the price list will also make room for various US indexes. Celgene’s position in the S&P 100 Index will be replaced by Thermo Fisher. The diagnostic company recently made headlines due to rumors of a possible acquisition of Qiagen. In S&P 500, Servicenow will inherit Celgene. This company provides an exciting growth story.

At this point, I have repeatedly reported the secondary value of Serviceware. You can read the initial analysis again here. If you want, the American company Servicenow is an outstanding example of Serviceware and a fully functional software as a service (SaaS) company. Servicenow’s share growth is incredible, or it’s still in the middle. Only recently has there been difficult news.

For a long time, SAP CEO Bill McDermott (Bill McDermott) will be promoted to Servicenow, and will become the new CEO and board member at the end of this year. In turn, former CEO John Donahoe (John Donahoe) will also be transferred to Nike. McDermott has set ambitious goals and plans to increase sales to $10 billion in the next few years. It should be around $3.45 billion in 2019. Revenue is currently growing at a rate of 30%, which is worthy of respect for a company with a market value of 50 billion US dollars.

Like many SaaS stocks, valuations are certainly high. P/E ratios are 87 and 67, respectively, and KUV are 15 and 12. However, the company’s development is also breathtaking. Here are some dates:

Servicenow had 400 employees in 2011, compared with 8,000 last year. From 950 customers in 2011 to about 5,400 in 2018, the business with 675 customers had a turnover of more than $1 million per customer and only 20 customers.

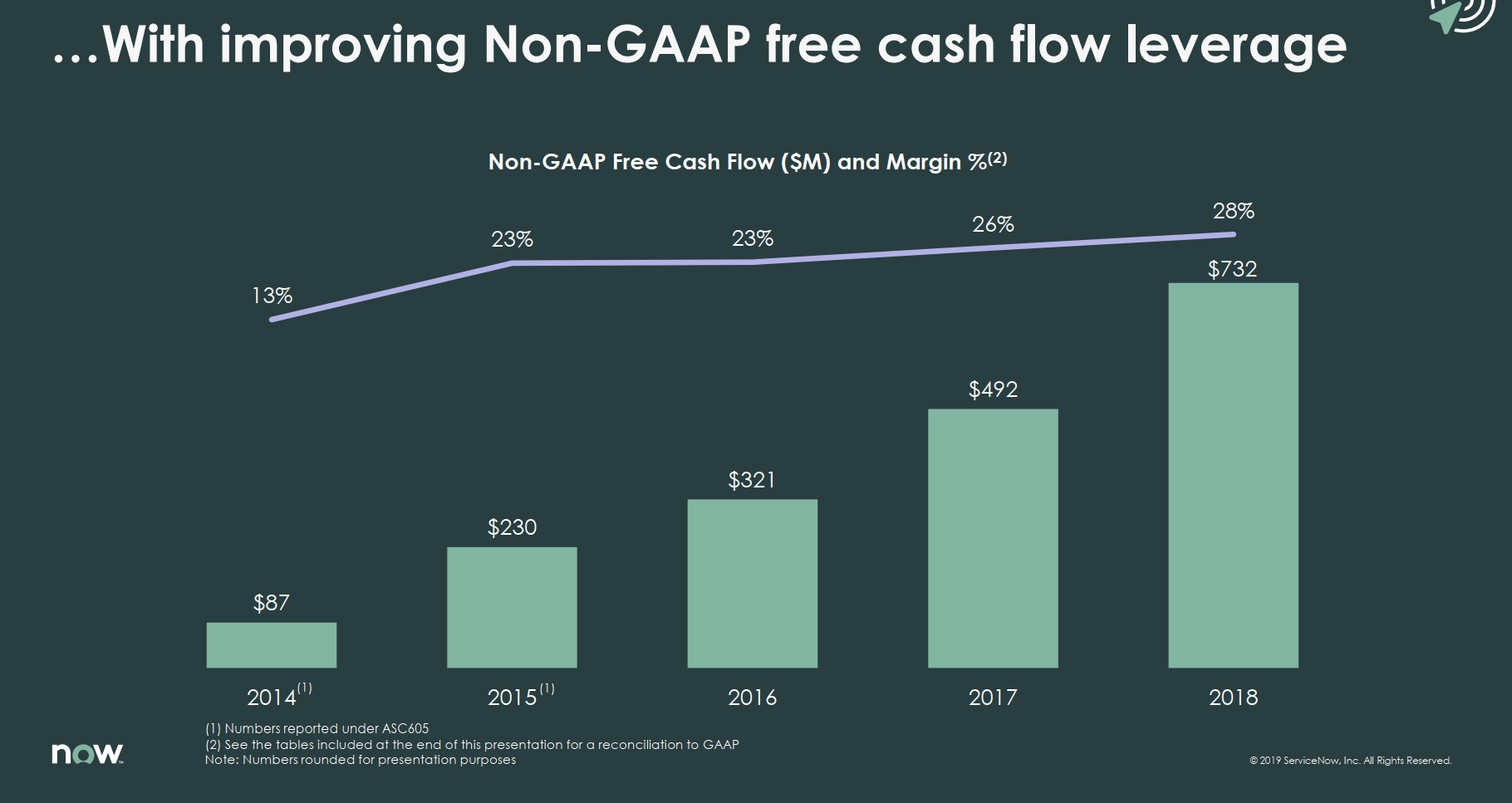

The development of free cash flow in the past few years has also been impressive:

What: Servicenow

In the next few years, Servicenow’s market will grow by an average of 8%. By 2023, the transaction volume is expected to reach around US$165 billion. The company’s official forecast for 2020 is at least $4 billion in revenue. Analysts currently assume it is $4.4 billion. Operating profit margin is expected to increase by another 100 basis points. Profit growth should reach 30%. In an interview with Handelsblatt, McDermott did not prevent further growth in mergers and acquisitions, but Servicenow believes that it is mainly organic growth.

| year | 2018 | 2019* | 2020e * |

| Billion dollars in sales | 2,61 | 3,45 | 4,43 |

| Earnings per share (USD) | 2,49 | 3,24 | 4,22 |

| Revenue growth | 30,12% | 30.25% | |

| truck | 113 | 87 | 67 |

| I | 20,2 | 15,3 | 11,9 |

| Polyethylene glycol | 2,9 | 2,2 | |

| * e = expected |

From a technical chart point of view, after a significant correction, the share was in good shape again before October. The upward resistance at $274.50 and $276.50 has officially ended the correction. With or without falling to 268.45 US dollars, the next few weeks may break through the historical high of 302.99 US dollars. As long as the mid-term low of $238.29 is not reduced, this situation will continue.

Share now

Share now

(© GodmodeTrader 2019- Author: Bastian Galuschka, Acting Chief Editor)

.

#SERVICENOWbecome #member #tomorrow

More from Source