Berkshire Hathaway’s Charlie Munger -backed external fund manager Li Lu, was indifferent to this when he said ‘The biggest risk in investing is not the volatility of prices, but if you will suffer a permanent loss of capital . ‘ It’s only natural to consider the company’s balance when you’re evaluating how risky it is, because debt is often involved when a business collapses. Let’s notice that ServiceNow, Inc. (NYSE: NOW) owes its balance sheet. But the real question is whether this debt makes the company risky.

Why Is Debt Risk?

Debt helps a business until the business has trouble repaying it, either with new capital or with free cash flow. Part and parcel of capitalism is the process of ‘creative destruction’ in which failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still expensive) scenario is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to increase its balance sheet. Of course, many companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest review for ServiceNow

What is ServiceNow Debt?

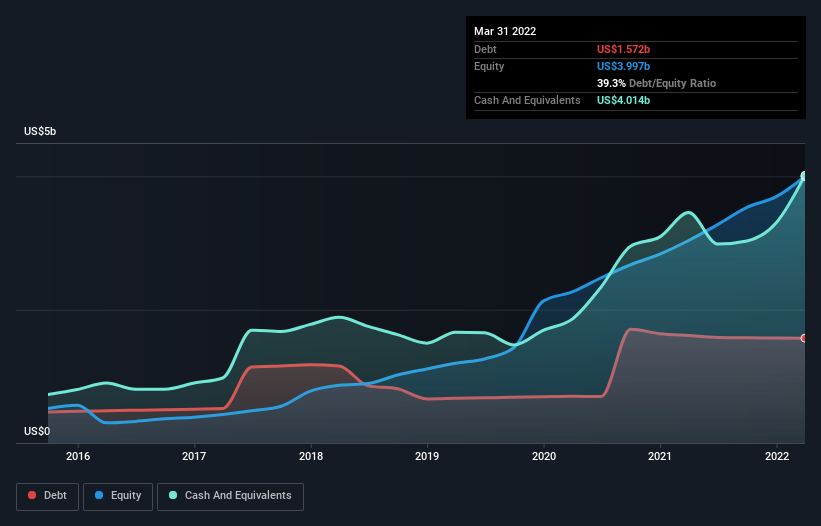

As you can see below, ServiceNow had US $ 1.57b in debt, in March 2022, which is almost the same as last year. You can click the chart for more details. But it also has US $ 4.01b cash to recover that, meaning it has US $ 2.44b net cash.

A Look At ServiceNow’s Responsibilities

We can see from the latest balance that ServiceNow has liabilities of US $ 4.85b to be paid over a year, and liabilities of US $ 2.14b to be paid in excess of that. In its offset, it has US $ 4.01b in cash and US $ 824.0m in receivables due within 12 months. So its liabilities total US $ 2.16b more than the combination of its cash and short -term receivables.

Of course, ServiceNow has a titanic market capitalization of US $ 97.1b, so these liabilities are likely to be manageable. Given what it said, it is clear that we should continue to monitor its balance, lest it change for the worse. While it has responsibilities to keep in mind, ServiceNow also has more money than debt, so we’re pretty confident it can manage its debt safely.

While ServiceNow doesn’t seem to have earned much on the EBIT line, somehow earnings remain stable so far. There is no doubt that we have learned a lot about debt from the balance sheet. But ultimately the future profitability of the business will decide whether ServiceNow can strengthen its balance over time. So if you are focused on the future you can take a look at it Free report showing analyst earnings forecasts.

Finally, a company can only repay debt using cold hard cash, not accounting profits. ServiceNow may have net cash on the balance, but it will be interesting to see how well the business converts its earnings before interest and tax (EBIT) into free cash flow, as this will influence both its demand, and capacity. its to manage debt. Happy for any shareholder, ServiceNow has actually generated more free cash flow than EBIT over the past three years. That kind of powerful currency conversion makes us happy like most people when the beat drops at a Daft Punk concert.

Summing up

We can understand if investors are concerned about ServiceNow’s liabilities, but we can be assured of the fact that it has a net cash of US $ 2.44b. And it impressed us with a free cash flow of US $ 1.9b, which is 749% of its EBIT. So is ServiceNow debt a risk? It doesn’t seem to be us. Balance is clearly the area to focus on when you are evaluating debt. But ultimately, every company may contain risks that exist out of balance. To that end, you should know 1 warning we found in ServiceNow.

Of course, if you’re the type of investor who prefers to buy stocks without a debt burden, then feel free to explore our exclusive list of net cash growth stocks, today.

Do you have feedback on this article? Worried about content? Please contact directly to us. Alternatively, email editorial-team (at) simplywallst.com.

This Simply Wall St article is general. We provide commentary based on historical data and analyst predictions using only an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take into account your goals, or your financial situation. We aim to bring you long -term focused analysis driven by core data. Note that our review may not factor in the latest company announcements that are sensitive to price or material quality. Simply Wall St does not have a position in any of the stocks mentioned.