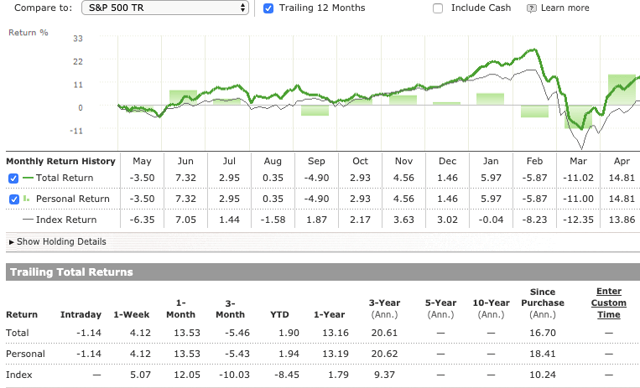

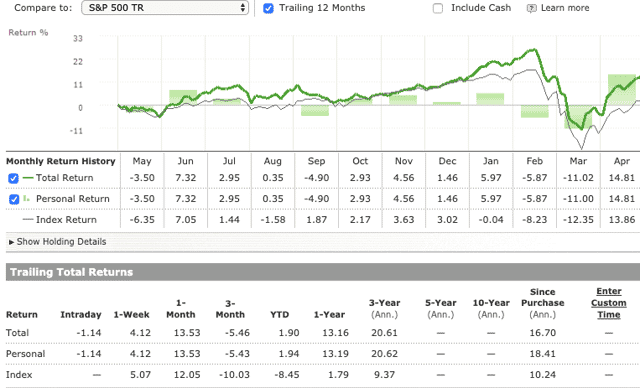

April is a welcome respite for the million-dollar project portfolio. After experiencing major setbacks in February and March, April eliminated most of the losses in the past two months, making the portfolio soar at the end of the year.

As of April, the $1 million project portfolio has grown by 15%, compared to the Standard & Poor’s 500 Index (SPY) by 13%. It can be said that this is the best month for the $1 million project, of course it has been the past 12 months, and it may also be the best month since the project started. There is no job drop this month, there are many jobs, such as Veeva (VEEV), Mercadolibre (MELI), ServiceNow (NOW), Promedicus (OTCPK: PMCUF), Facebook (FB) and Amazon (AMZN), which have increased by more than 20% this month.

Of particular interest in the collapse and subsequent recovery is the rate of decline and the rate of rise. The days of sharp decline in March are characterized by a 7% drop in consecutive days and a decline in the index, which is particularly painful. I have prepared myself for a decline of more than 20%, but the rate of decline in March was like a punch. Contrary to what might happen, I feel that these drops are as large as the next person.

It is also shocking that the portfolio was not acquired until April and it has been difficult to rationalize so far. However, especially the latest results from companies such as Facebook and ServiceNow give me reason to believe that, at least on the high-quality end of the spectrum, these low points of decline are likely to have been reached.

The speed of recovery also shows you how difficult the market timing is. Those who turned to collecting during the worst decline may be absorbing losses because they sold too late and did not buy back stock early enough. I deeply respect the heroic actions of those who make a living by shorting the market or buying and selling stocks. As we saw last month, the timing of these bets is so difficult and so dangerous.

Portfolio history

My broader investment in the $1 million project is focused on a series of high-growth, cash-generating business purchases and long-term ownership driven by long-term growth. The benefit of these ancient tailwinds is that the selected company can develop under any economic conditions that may be encountered during the life cycle of a $1 million project portfolio (ten years or more).

The market can move the price of a project company worth one million dollars at will. However, I am concerned about the long-term investment income that my company can generate and the possibility of deploying that investment capital with a high rate of return in the long term. For those who are new to the project, here are part 1, part 2 and part 3 of the initial investment in the portfolio.

The overall goal of the portfolio is to transform the capital base of US$275,000 originally deployed in November 2015 to US$1,000,000 before November 2025, surpassing the S&P 500. This is mainly through purchasing and owning a high-quality business, which helps increase returns and minimize tax and transaction costs. The initial capital of US$275,000 has been fully deployed and will not increase during the remaining life of the project.

This $1 million project ended in April, with a balance of nearly $551,000, an increase of nearly $60,000 that month. Since the beginning of this year, the performance of the $1 million project has been interesting. When the conditions are right, he can attack, take advantage of high-quality opportunities, and reduce the loss of the poor market under particularly bad conditions in February and March, and surpass the market again. April performance when mood improved.

For portfolio performance, minimizing loss capture has always been a new and valuable point of view for me. This is an undervalued attribute, but I think it is very important for me to maintain a more aggressive growth portfolio. I observed a similar phenomenon in May 2019, when the index fell by nearly 6.4%, and the $1 million project performed equally well, as was the stock market crash in December 2018.

Streamlining a large enterprise might make it look stupid

I decided to divest some assets of Amazon, Facebook and Visa in March, and then market the revenue of Adobe (ADBE) and Service Now (NOW). These are two companies that I have enjoyed for a while. Amazon, Facebook, and Visa (V) are all champions, and there is no doubt that giving up a big company (or even part of it) will make someone look crazy. Therefore, it is not surprising to me that both Facebook and Amazon’s share price performance in the month were very strong, with a return of more than 20%.

I do not regret making any of these decisions and deploying recipes in Adobe and ServiceNow. Part of the reason for the decrease in positions is that each position represents a portfolio. I think both Adobe and ServiceNow have the ability to become an important part of my portfolio in the next five years, such as Amazon or Facebook. These two companies have now become large companies. . My decision here is not based on the next two months, but based on the five and a half years that the project has not been in operation.

Why we may see the worst reason for the decline in high quality

Since the early results of the portfolio came from positions such as Google, Facebook and ServiceNow, I think we have seen the biggest drop. Although this is the opposite of most markets and in an inconsistent pace, my reason is that little is known about the latest results, not the future directions and opinions provided by the company. I think ServiceNow, Veeva and Atlassian are the best examples.

At the height of the crisis, as other companies scrambled to withdraw their forecasts, ServiceNow took the lead in proposing and confidently announcing the full-year revenue forecast for 2021 at 25-26%. This is not an isolated case, as Veeva also provides solid prospects in March 2021, indicating a full year growth of 26%. The name of the high-quality, ancient growth technology becomes more obvious. They provide mission-critical software, many of which are locked in a subscription contract, which means that the company software license that resigns usually loses all that the software provides Features.

As far as ServiceNow is concerned, this is essential IT productivity software that can help IT professionals deal with the challenges of more virtual employees. Take Veeva as an example. It is the software and collaboration tools that life science companies rely on for drug discovery and production, many of which must now be done in a remote environment. Among other $1 million project portfolios, Salesforce (CRM), Adobe, and Atlassian (NASDAQ: TEAM) are the same. The results of the Atlassian report echo similar themes. Not only did the company perform well in the March quarter, but it also expects revenue to grow by nearly 30% in the coming months.

These characteristics have helped to bring the prices of these stocks to bottom, especially considering the bullish stance given so far. For other high-quality, subscription-free e-commerce companies, such as Alibaba (BABA), Mercadolibre (MELI) and Amazon, anecdotal evidence of worker shortages and strong consumer demand suggests that people have switched from offline commerce to online trade. Help to further strengthen the disadvantages of these businesses.

This is not to say that given the long-term nature of other S&P 500 companies and how slow growth and debt-laden companies will be severely affected, the broader index will not fall and hit new lows. However, I think the $1 million project portfolio is likely to reach the lowest level of the March bear market.

prospect

Since the beginning of this year, the investment portfolio is now positive, and the company has provided positive updates in the portfolio initially reported, and I still believe that there will be double-digit returns this year. Much depends on the income and income growth of each part of the portfolio for the rest of the year, but since there are early signs and suggestions that most people expect to continue to maintain double-digit growth, I will continue to pay attention. The prediction made at the beginning of the year was that “by 2020 there will still be more than ten percent yield.”

To see other ideas for high-quality, growing companies that are positioned as long-term wealth creators, please consider Free trial for sustainable growth.

- These ideas are based on the idea of a $1 million project, Outperforms the S&P 500 Index Almost 50% reduction 2019 and the past 4 years

- Can use large-cap models, emerging leaders and high-conviction portfolios Better than the S&P 500 Index In 2019

- The watch list covers many companies with “unfair competitive advantage” in a fast-growing market

- Exclusive thoughts on potential “tomorrow’s wealth creators”

Disclosure: I/we have been GOOGL, V, FB, NOW, ADBE, MELI, BABA, TEAM, AMZN, VEEV, PMCUF, CRM, SPY for a long time. I wrote this article myself and expressed my opinion. I have not received any compensation for this (except Seeking Alpha). I have no business relationship with the company whose actions are mentioned in this article.

Editor’s note: This article discusses one or more securities that are not traded on major US stock exchanges. Please be aware of the risks associated with these securities.

#million #project #breathtaking #April #Amazon #ServiceNow #Facebook

More from Source