Wall Street was in an unusually bullish mood Tuesday morning.

Tim Holland, chief investment officer at Orion Advisor Solutions, argued that the market had only gained two peaks. Last week, the Department of Labor finally reported a slight drop in inflation, as a measure of individual investor sentiment showed the largest percentage of individual investors being bearish since 2009.

“If we see peak inflation and peak investor pessimism the path forward for the market should be more favorable,” Holland said.

Not everyone is convinced. Credit Suisse’s London -based global strategy team has been wary of stocks since February – and they still are. They say the risk of recession remains very high and there is no increase in their fair value models. Importantly, the risk to the company’s profits remains high.

“Income changes have started to fall and 71% of the time when they happen, markets fall in the next quarter. The current PMIs indicate a significant additional downside to the changes. We see a clear risk of negative EPS in 2023, ”said strategists led by Andrew Garthwaite.

Sure, the markets dropped after about a 19.5% drop from their peak-the intraday low on the S&P 500 SPX,

reached on Thursday – but in three of those four instances, the Fed loosened up.

For the Credit Suisse team to be bullish, it will need, more or less, clear signs that the Fed’s increases are holding back the economy.

“What do we need to see to be more constructive? Clear signs of slowing U.S. wage growth, U.S. lead indicators have fallen sharply indicating the Fed needs to do less to get unemployment to rise than full employment, signs a new paradigm that shows that margins can remain high even as nominal GDP slows [8 percentage points]clear cut undervaluation of [equity risk premium] model, or credit spreads with a discount in the recession, ”Garthwaite and the team said.

The buzz

Hong Kong -listed stocks including JD.com JD,

Alibaba BABA,

at NetEase NTES,

jumped as Shanghai set plans to reopen from its tight lock, including a full reopening on June 1. JPMorgan also upgraded a group of Chinese technology stocks listed in the US on Monday .

Elon Musk – on Twitter, of course – said that his offer for the social -media service TWTR,

cannot move forward until the company provides more details on the proportion of spam accounts. CEO Parag Agrawal said he was confident that spam accounts represented less than 5% of the user base, and said the company was ‘committed to completing’ a $ 54.20-a-share deal with a proxy statement. Separately, Musk may sell shares to SpaceX to help fund the bid, the New York Post reported.

It’s been a big day on the retail front, as Home Depot HD,

reported a surprise increase in sales growth at the same store, but Walmart WMT,

shares are hit by loss of revenue and reduction in outlook. The April retail sales report is expected to show an acceleration in spending, driven by vehicle sales. Industrial production and a home builder’s emotional report should also be released.

Federal Reserve Chairman Jerome Powell is due to appear at 2pm Eastern at The Wall Street Journal’s Future of Everything Festival. Several regional Fed presidents will also speak, from the hawkish James Bullard to the dovish Neel Kashkari.

Check out interviews with Powell, the CEOs of companies including Wells Fargo, Moderna and FanDuel. Register for virtual access to The Wall Street Journal’s Future of Everything Festival, May 17-19. (Choose a virtual pass for complimentary access.)

A wave of 13-F reports from leading shareholders were filed with the Securities and Exchange Commission. Berkshire Hathaway announces new stakes in Citigroup C,

Paramount Global FOR,

at Celanese CE,

Among others. Chase Coleman’s Tiger Global Management, which struggled this year, has strengthened stakes in several tech plays including CrowdStrike Holdings CRWD,

SE Sea,

Snowflake SNOW,

ServiceNow NOW,

at Carvana CVNA,

The markets

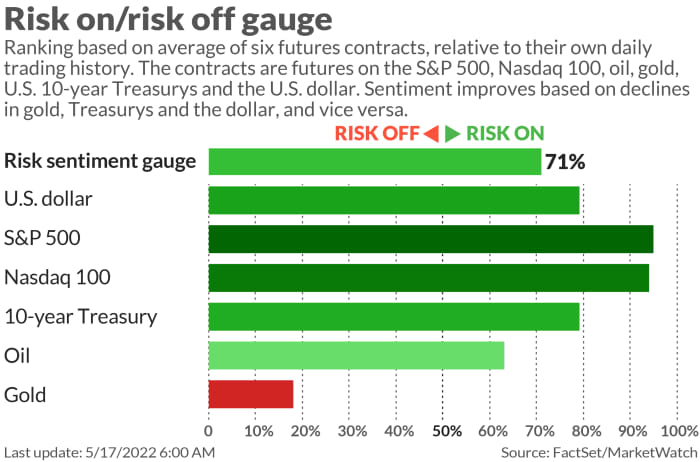

Markets seem to be flying higher, as US stock futures are ES00,

NQ00,

rose and the DXY dollar,

fell. Treasury yields TY00,

TMUBMUSD02Y,

also climbs.

Top tickers

Here are the most active stock-market tickers at 6 am Eastern.

|

Ticker |

Name security |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

TWTR, |

|

|

NIO, |

Nio |

|

AAPL, |

Apple |

|

MULN, |

Mullen Automotive |

|

AMZN, |

Amazon.com |

|

BABA, |

Alibaba |

|

NVDA, |

Nvidia |

The chart

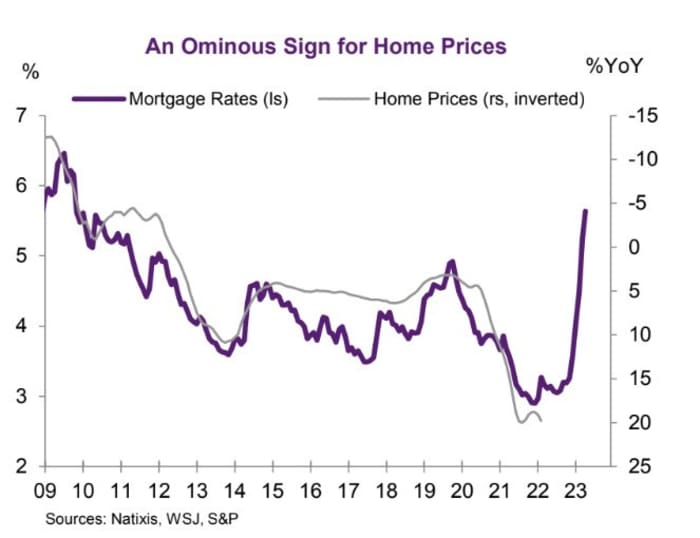

Correlation does not mean cause, and dual Y-axis charts can be manipulated to show closer correlations. So with all those caveats in mind, U.S. economists at Natixis point to the close correlation between mortgage rates and house prices, pointing to a perhaps sharp risk to wealth impact. .

They point out, however, that the intensity of the slowdown in house prices may not be as noticeable as the chart suggests, given the national housing shortage of both the pandeic housing boom and ongoing supply chain issues. A mid single digit correction in home prices next year is “absolutely reasonable.”

Random reading

The U.S. military throws away about $ 50,000 in bonuses to recruits, due to salary at companies like Target and Starbucks.

How Shanghai residents used Excel to navigate the lockdown.

The Need to Know starts early and is updated until the bell rings, but sign up here to have it delivered once to your email box. The emailed version will be sent at about 7:30 am Eastern.

Want more for the next day? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

.