Today, we will take a look at the complete ServiceNow, Inc. (NYSE: NOW). In the past few months, the company’s stock has received a lot of attention due to the sharp price increase on the New York Stock Exchange. As a large stock that analysts are paying attention to, you can assume that any recent changes in the company’s outlook have been factored into the stock price. But what if there is still a buying opportunity? Today, I will analyze the latest data on ServiceNow’s outlook and valuation to see if the opportunity still exists.

Check out our latest analysis of ServiceNow

Is ServiceNow still cheap?

According to my valuation model, the stock is currently overvalued by about 40%, and the transaction price is $484, while my intrinsic value is $346.83. This is not the best news for investors looking to buy! If you like these stocks, you may want to watch for potential price drops in the future. Given that ServiceNow’s share is quite unstable (that is, its price is amplified relative to the price fluctuations of other markets), this may mean that prices may fall, giving us future purchase opportunities. This is based on its high beta, which is a good indicator of stock price volatility.

What is the future of ServiceNow?

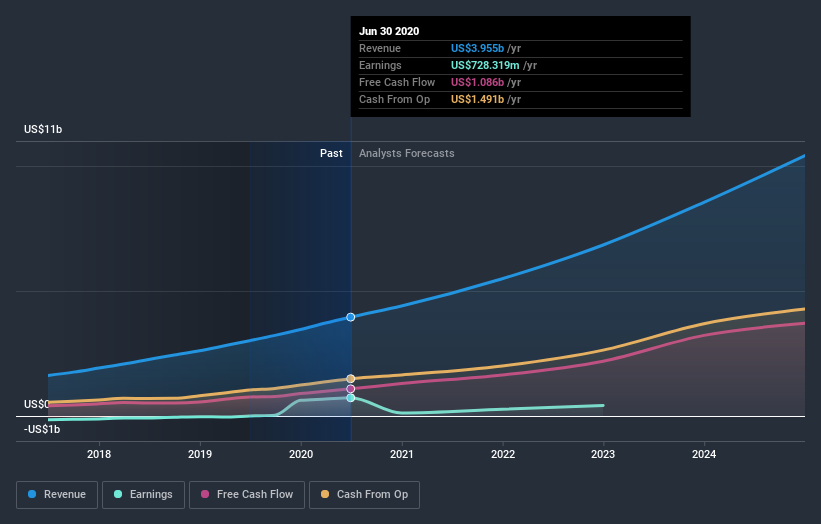

When you are planning to buy stocks, especially if you are an investor looking for portfolio growth, future prospects are an important aspect. Although value investors think that the most important thing is intrinsic value relative to price, a more attractive investment argument is to achieve high growth potential at a low price. Although as far as ServiceNow is concerned, its earnings are expected to show a high degree of negative growth in the next few years, which does not help establish its investment thesis. At least in the short term, the risk of future uncertainty seems high.

What this means to you:

Are you a shareholder If you think you should trade at a price lower than the current price now, then selling the high price when the price drops to its actual value and buying again can make you profit. Considering the risks posed by negative growth prospects, this may be the right time to reduce the total portfolio risk. But before making this decision, please check whether its fundamentals have changed.

Are you a potential investor? If you have been on NOW for a period of time, now may not be the best time to enter stocks. In addition to the risky future prospects, the price increase has exceeded its true value. However, we have not considered other important factors today, such as its management records. Should the price fall in the future? Do you have enough news to buy?

If you want to learn more about ServiceNow as a business, it is important to know any risks that ServiceNow faces.During the analysis, we found that ServiceNow has 2 warning signs It is unwise to ignore these.

If you are no longer interested in ServiceNow, you can use our free platform to view our list of 50 other stocks with high growth potential.

Promotion

If you decide to trade ServiceNow, please use the lowest cost* platform, which is rated #1 by Barron’s Interactive Brokers in the overall market. Trade stocks, options, futures, foreign exchange, bonds and funds in 135 markets through a comprehensive account.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, nor does it consider your goals or financial situation. We aim to bring you long-term focused analysis driven by basic data. Please note that our analysis may not consider the latest announcements or qualitative materials from price-sensitive companies. Simply put, Wall Street has no position in any of the stocks mentioned.

*Interactive Brokers named the lowest-cost broker online review 2020 by StockBrokers.com

Have any comments on this article? Concerned about the content? keep in touch Contact us directly. Or, send an email to [email protected].

Calculation of discounted cash flow for each stock

Simply Wall St will perform detailed discounted cash flow calculations for each stock in the market every 6 hours, so if you want to find the intrinsic value of any company, please search here. free.

#time #buying #ServiceNow #NYSENOW