In the past 3 months, 11 analysts have published their views on ServiceNow (NYSE: NOW) stock. These analysts are usually employed by large Wall Street banks and are responsible for understanding the company’s business in order to predict the stock trading situation in the coming year.

| Bullish | A bit bullish | indifferent | A bit bearish | Bearish | |

|---|---|---|---|---|---|

| total score | 5 | 5 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1 million years ago | 0 | 1 | 0 | 0 | 0 |

| 2 million years ago | 3 | 3 | 0 | 0 | 0 |

| Before 3M | 1 | 1 | 1 | 0 | 0 |

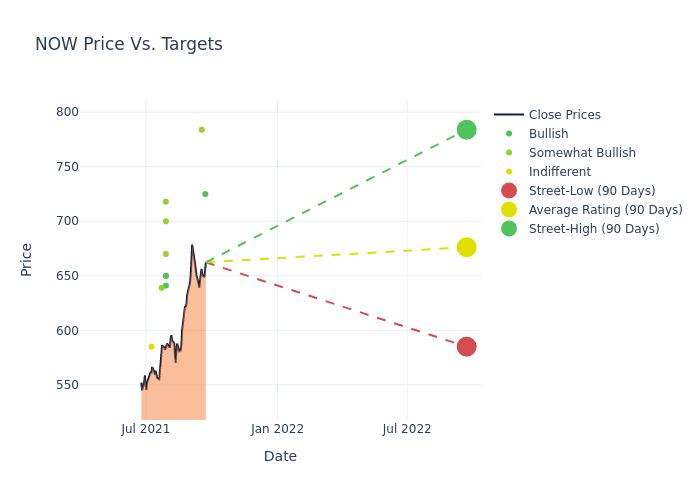

In the past 3 months, 11 analysts have provided ServiceNow with 12-month price targets. The company’s average target price is US$672.91, the highest price is US$784.00, and the lowest price is US$585.00.

Below is a summary of how these 11 analysts have evaluated ServiceNow in the past 3 months.The more the number of bullish ratings, the more positive the analyst’s view of the stock, and the more the number of bearish ratings, the more negative the analyst’s view of the stock

The current average price is 9.1% higher than the previous average target price of $616.8.

Ratings come from analysts or experts in the banking and financial system who report on specific stocks or specific industries (usually once per stock per quarter). Analysts usually get information from company conference calls and meetings, financial statements, and conversations with key insiders to make decisions.

Some analysts will also provide forecasts on growth estimates, earnings and income indicators to provide further guidance on stocks. Investors who use analyst ratings should be aware that this professional advice comes from humans and may go wrong.

#ServiceNow #Expert #RatingAsia #Resources

More from Source