With its stock down 24% over the past three months, ServiceNow (NYSE:NOW) is easy to ignore. But if you pay close attention, you can see that its key financial indicators look pretty decent, which could mean that the stock could potentially rise in the long term given how markets often reward more resilient long-term basis. In this article, we decided to focus on ServiceNow’s ROE.

Return on equity or ROE is an important factor for a shareholder to consider because it tells them how effectively their capital is being reinvested. Put another way, it shows the company’s success in turning shareholder investments into profit.

Check out our latest review for ServiceNow

How Do You Calculate Return On Equity?

The formula for ROE are:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

So, based on the formula above, the ROE for ServiceNow is:

4.4% = US$184m ÷ US$4.2b (Based on the trailing twelve months to June 2022).

The ‘return’ is what the business earned in the previous year. That means that for every $1 worth of shareholders’ equity, the company generates $0.04 in revenue.

What Does ROE Have to Do with Profit Growth?

So far, we have learned that ROE is a measure of a company’s profitability. Based on how much of its earnings the company chooses to reinvest or “retain”, we assess the company’s future ability to generate revenue. In general, other things being equal, companies with high return on equity and earnings retention, have higher growth rates than companies that do not share these characteristics.

A Side-by-Side Comparison of ServiceNow’s Revenue Growth And 4.4% ROE

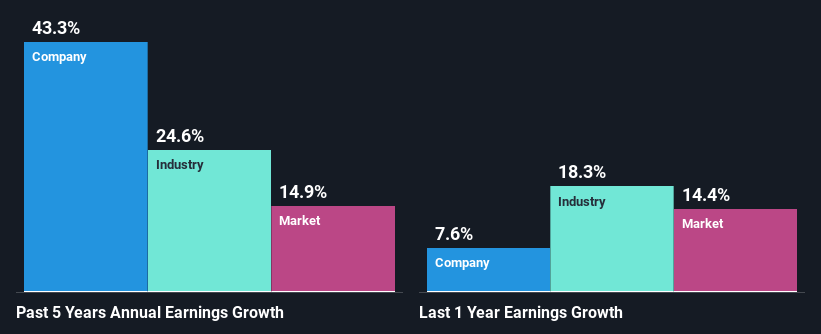

On the face of it, ServiceNow’s ROE isn’t much to talk about. We then compared the company’s ROE to the broader industry and were disappointed to find that the ROE was lower than the industry average of 12%. However, we were pleasantly surprised to see that ServiceNow has grown its net income at a significant rate of 43% over the past five years. We suspect there may be other factors at play here. For example, it is possible that the company’s management has made some good strategic decisions, or that the company has a low payout ratio.

We then compared ServiceNow’s net income growth to the industry and were pleased to see that the company’s growth number was higher when compared to the industry with a growth rate of 25% over the same period.

Earnings growth is a big factor in stock valuation. It is important for an investor to know whether the market has priced in the company’s expected earnings growth (or decline). By doing this, they will have an idea of whether the stock is headed for clear blue water or if swampy waters await. Is NOW valued fairly? This infographic on company intrinsic value has everything you need to know.

Is ServiceNow Efficiently Reinvesting Its Earnings?

ServiceNow does not pay any dividends at the moment which essentially means that all of its profits are being reinvested in the business. This certainly contributes to the high revenue growth numbers we discussed above.

Conclusion

Overall, we feel that ServiceNow has several positive attributes. Despite its low rate of return, the fact that the company has reinvested a very high portion of its profits into its business, undoubtedly contributed to its high revenue growth. The latest industry analyst forecasts show that the company is expected to maintain its current growth rate. To find out more about the latest analyst forecasts for the company, check out this visualization of analyst forecasts for the company.

Do you have feedback on this article? Worried about content? Please contact directly to us. Alternatively, email editorial-team (at) simplywallst.com.

This Simply Wall St article is general. We provide commentary based on historical data and analyst forecasts using only an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take into account your goals, or your financial situation. We aim to bring you long-term focused analysis driven by primary data. Note that our review may not factor in the company’s latest price-sensitive or material quality announcements. Simply Wall St has no position in any of the stocks mentioned.

Valuation is complicated, but we help make it simple.

Find out if Service Today is potentially over- or under-priced by checking out our comprehensive review, which includes fair value estimates, risks and caveats, dividends, insider transactions and financial health.

Check out the Free Review