Onvista meal sample portfolio value ServiceNow announced the quarterly figures yesterday, which exceeded expectations. A cloud solution provider from California was able to realize profits for the first time under the leadership of the new CEO Bill McDermott. Bill McDermott, the former CEO of software giant SAP, moved to the company late last year.

Adjusted earnings increased by 25% to 96 cents per share. Revenue grew 33% to 951.8 million US dollars. In 2019, profit was still 77 cents per share and sales were $715.4 million. McDermott said in a press release: “In the fourth quarter, we completed a record-breaking transaction and promoted the extensive expansion of the Now platform.” “Digital transformation is driving our vitality, because customers from all walks of life are familiar with the ease of ServiceNow. Sex is appreciated.”

Most of the revenue comes from license revenue-899 million US dollars. The outlook for the first quarter of 2020 is also better than analysts expected. ServiceNow expects subscription revenue to be between US$975 million and US$980 million, while analysts expect it to be US$960 million. For the full year of 2020, the company’s goal is to achieve sales of $4.23 billion in this area-a 30% increase over 2019.

What does ServiceNow do?

ServiceNow, among other things, also produces service management software for information technology. The self-service technology portal allows company employees to access management and workflow tools to directly solve problems for customers. The company’s core business is the management of IT operations incidents related to incidents, problems and changes.

It also recently announced the acquisition of Israeli start-up Loom Systems. The company provides a solution to proactively predict and prevent IT incidents-as an extension, it fits well with ServiceNow’s previous business model.

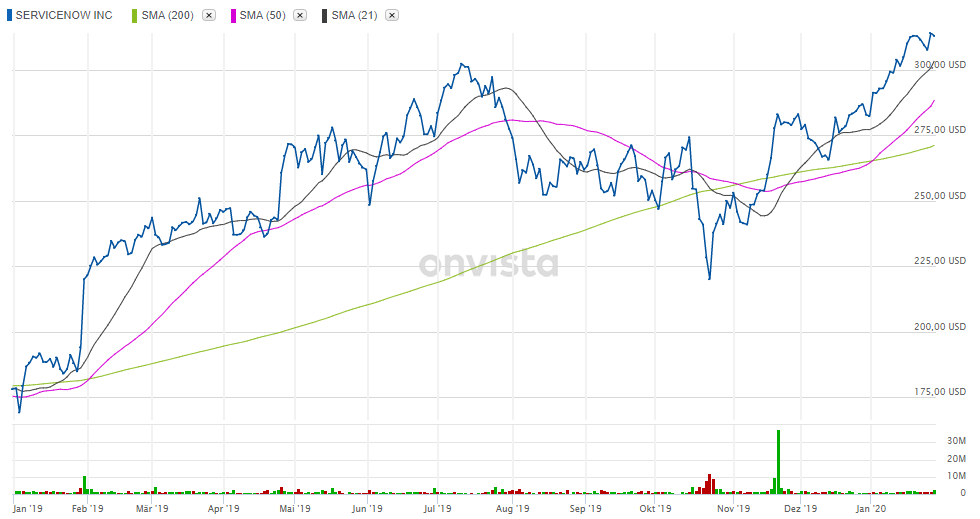

In the long run, the share is on the rise. In the long run, the growth will exceed 350%, and its share will be less than 76% in a year. The last major setback occurred when McDermott announced the new CEO. The stock fell by more than 10%, but it has since recovered more than that. According to yesterday’s data, the stock rose another 6% in after-hours trading.

Editor-in-chief Markus Weingran realized this share earlier and added it to his onvista meal sample portfolio.

Onvista editorial team

Titelfoto: Miscellaneous Photography/Shutterstock.com

-display-

5G exploded. Now, this stock can benefit from the huge cellular revolution!

5G ushered in a new era in terms of speed and response time. Brand new application areas in industry, science and entertainment are opening up. For example for virtual reality, autonomous driving or the Internet of Things. The company is in a very advantageous position and can benefit a lot from this century’s trends in the wireless field. This is the key link for all data that travels around the world via cellular waves. We want to provide you with all the detailed information about this company. Click here for more information about stocks that we believe will benefit from this trend. Ask us to provide a new free special report”Can benefit from a huge share of the 5G mobile communications revolution” From now on!

.

#ServiceNow #Excellent #quarterly #data #stock #prices #climbgrowth #remains #unchanged

More from Source